The Connecticut minimum wage in 2024 is $15.69 per hour after a mid-year July 1st increase from $15.00 per hour.

For a state to increase its minimum wage more than once in a calendar year is seen as quite different than most states.

However, it is not totally outside the realm of possibility – the same happened in 2019 with the minimum wage in Delaware.

Related: Delaware State Minimum Wage

It is key that employers in Connecticut have a clear understanding of the minimum wage rate and the specific laws that apply to it.

Equally, employees in the state need to be aware of what they are entitled to and how much they should be paid as well as any labor laws they are protected by.

Here are your earnings as a Connecticut employee being paid the state minimum wage rate:

- Daily Minimum Wage: $125.52 (based on an 8-hour working day).

- Weekly Minimum Wage: $627.60 (based on a 40-hour week).

- Monthly Minimum Wage: $2,719.60 (based on a full-time month).

- Yearly Minimum Wage: $32,635.20 (based on being paid for 2080 hours per year).

It is, however, important to note that the potential minimum wage earnings are before any income tax has been deducted.

The new laws affecting the Connecticut state minimum wage will ensure that there will be a consistent increase in the minimum wage over the next several years.

This resulted in the minimum wage increasing to $15.69 per hour by June 1st, 2024.

Governor Ned Lamont signed legislation that he championed alongside several other state legislators that will ensure the minimum wage grows according to federal economic indicators, so everyone can continue to share in Connecticut’s prosperity.

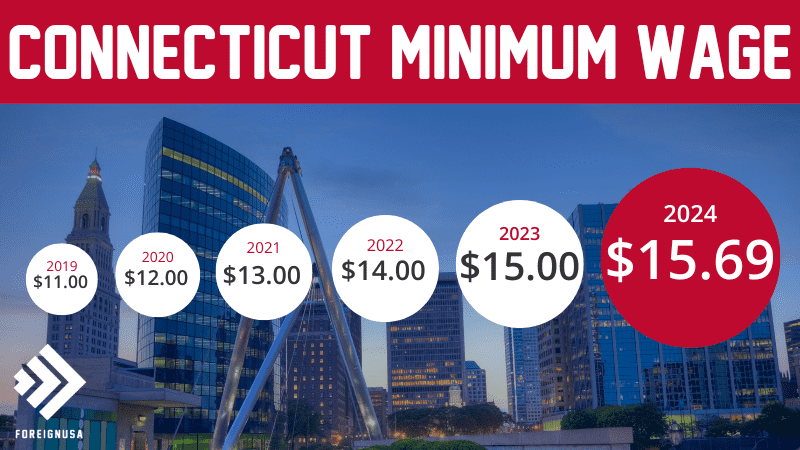

The graphic below shows the Connecticut state minimum wage each year over the past several years.

As you can see, the minimum wage has been increasing positively each year, reflecting the state’s strong economic position:

Connecticut Minimum Wage Increases and Future Years

The Connecticut minimum wage did not increase at all from 2010 to 2013 and only increased by 45 cents in 2014.

Since 2015 the minimum wage increased at a consistent rate each year until reaching $10.10 in 2017, where there was no increase seen over the next two years.

In 2019, a much more significant increase came into effect, with the Connecticut state minimum wage increased by 90 cents to $11.00 per hour.

This is a healthy 8.91% increase in just a year. The beginning of 2020 saw no increase in the Connecticut minimum wage.

However, on September 1, 2020, the Connecticut minimum wage increased by $1 to $12.00 per hour following Governor Ned Lamont’s signing of legislation to increase the minimum wage to $15.00 by June 2023.

Now, since the new law was signed, the Connecticut minimum wage increased as follows:

- $11.00 on October 1, 2019

- $12.00 on September 1, 2020

- $13.00 on August 1, 2021

- $14.00 on July 1, 2022

- $15.00 on June 1, 2023

This is calculated by the U.S. Department of Labor. For the first time in Connecticut, the minimum wage rate will grow according to economic indicators.

“This is perhaps one of the most impactful pieces of legislation for working families that a governor can sign, and I am proud to place my signature on this law because it is the right thing to do. With this new law, thousands of hardworking women and men – many of whom are supporting families – will get a modest increase that will help lift them out of poverty, combat persistent pay disparities between races and genders, and stimulate our economy. This is a fair, gradual increase for the working women and men who will invest the money right back into our economy and continue supporting local businesses in their communities.” – Governor Ned Lamont

Connecticut has had and will continue to have one of the highest minimum wage rates in the U.S.

Related: Highest State Minimum Wage Rates

You should be aware that Connecticut has many minimum wage exemption rates due to certain job roles and employment types.

Connecticut Minimum Wage Exemptions

In addition to the regular minimum wage rate, there are a few Connecticut state minimum wage exemptions that typically depend on your age or employment situation.

Below are the various minimum wage exemptions with some situational examples.

Connecticut Student Minimum Wage

The minimum wage for student employees in Connecticut is 85% of the Connecticut minimum wage, making their hourly pay $13.34 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible to be paid the Connecticut minimum wage rate of $15.69 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many Connecticut employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Connecticut Under 20 Minimum Wage

If you are under 20 years old in Connecticut, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 Connecticut minimum wage of $15.69 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Connecticut Tipped Minimum Wage

The tipped minimum wage in Connecticut is a little different from most other states. There are two different tipped minimum wage rates depending on your job role.

So, if you are a bartender in Connecticut, who usually customarily receives tips, then you are eligible to be paid a wage of $8.23 per hour, with a tip credit of $7.46, ensuring that you will still make the minimum hourly wage.

The other tipped minimum wage is $6.38 per hour for all hotel and restaurant workers, with a tip credit of $9.31.

Related: Tipped Minimum Wage in Connecticut

Connecticut Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40.

So, the overtime minimum wage in Connecticut is $24.46 per hour, 1.5 times the minimum wage of $15.69 per hour.

Other Connecticut Minimum Wage Exemptions

Here are the rest of the minimum wage exemptions for Connecticut due to different job roles:

- Those who work in camps or resorts that are only open for a maximum of six months per year.

- Those who work in domestic services for private homes.

- Those who work in a bona fide, administrative, or professional capacity by the federal government.

- Those who work as a volunteer for specific nonprofits.

- Those who work as a head resident or resident assistant at a college or university.

- Those who work as a babysitter.

- Those who work in outside sales as defined in the FLSA (Fair Labor Standards Act).

- Those who work as a member of the armed forces of the state performing military duty.

Connecticut Minimum Wage History

The table below shows the current rate and history of Connecticut’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

As you now know, Connecticut has one of the best minimum wage rates and systems out of all 50 states, but if you were curious about the other state minimum wage rates, take a look at our minimum wage in US states guide.

Connecticut Minimum Wage Poster and Department of Labor Contact Details

As a Connecticut employer, you need to keep yourself compliant with the law. To do this, you need to display a Connecticut Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Department of Labor website, and download the poster in English or Spanish.

If you wish to contact the department directly, here are all of the contact details you need:

Department of Labor

200 Folly Brook Blvd, Wethersfield,

CT 06109, USA

Telephone: 860-263-6000

Email: dol.webhelp@ct.gov