In the United States, employment laws, and more specifically, the minimum wage laws are not always clear, especially when you are considering the minimum wage for tipped employees.

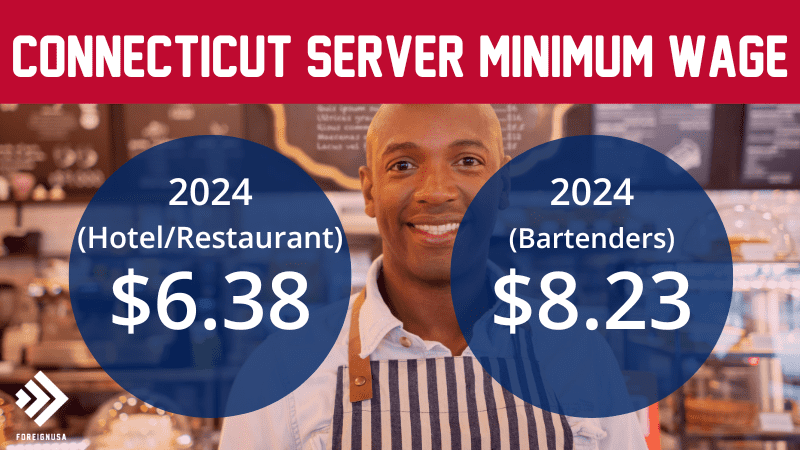

Connecticut is certainly no different – with a different tipped minimum wage rate depending on your employment type. So, if you are a bartender in Connecticut who receives tips, your minimum cash wage is $8.23 per hour, with a tip credit rate of $7.46.

Now, if you are an employee of a hotel or restaurant in Connecticut, you are eligible to be paid a minimum cash wage of $6.38 per hour and a tip credit of $9.31. Both of these payment structures result in the employee being paid the minimum wage in Connecticut of $15.69 per hour.

While tipping is perhaps not common practice in other countries, thousands and thousands of workers in the U.S. make the majority of their income through tips.

The majority of service-related employees base their entire salary on tips and rely on them to cover their living expenses, fund their lifestyle, and take care of their families.

What is a Tipped Employee?

A tipped employee earns their wages through tips rather than a fixed salary or higher hourly rate. Federal law establishes the rules of what is considered a tipped employee vs. a non-tipped employee.

As mentioned previously, the tipped minimum wage in Connecticut works slightly differently than most other states. The majority of states define a tipped employee as an employee who receives more than $30 per month in tips.

Whereas the tipped minimum wage in Connecticut is not determined by a specific amount of tips received per week, only if the job itself is eligible to receive tips. Additionally, there are two minimum wage rates for tipped employees in Connecticut, one for bartenders, and one for restaurant and hotel workers (and most service-related jobs).

Neither of those hourly rates amounts to much, which is where tip credit comes into play!

Tip credits are paid in addition to the minimum wage in Connecticut if the amount of tips received per hour, in addition to the tipped minimum wage equals less than the minimum wage for the state itself, of $15.69 per hour.

Tip Credits, and Other Considerations for Connecticut Employers

Since the rules for tipped employees are different than non-tipped employees, there are other ways that employers can calculate the minimum amount earned by a tipped employee. One of these ways is through tip credits.

There are two specific tipped credit rates in Connecticut, the same as the two tipped minimum wage rates, this means that employers will have to pay their employees the remainder of the Connecticut minimum wage rate after they have received their tipped minimum wage rate.

The tip credit for bartenders in Connecticut is $7.46 per hour, which when added to the tipped minimum wage rate of $8.23 per hour equals $15.69 per hour (CT minimum wage).

Additionally, the tip credit for hotel/restaurant employees is $9.31 per hour and the tipped minimum wage is $6.38 per hour, which again, equals $15.69 per hour.

This minimum wage rate ensures that servers, hospitality, and others working tipped roles in Connecticut who do not make enough with tips can earn a weekly wage when working full-time.

Connecticut Tipped Employees and Tipped Minimum Wage

To comply with the Connecticut minimum wage law, employers must ensure that when including tips, their employees are being paid at least the state minimum wage rate set for Connecticut workers.

If those employees are not making that minimum pay rate via tips, it is then the employer’s responsibility to make up the difference.

Several different factors of employment law impact how Connecticut employers handle tipped employees.

Understanding the minimum wage in Connecticut, the federal laws controlling wages, and how pay and wages work for tipped employees is important, especially if you are operating or thinking about starting a service-related business with tipped employees.

The Connecticut minimum wage is currently $15.69 per hour for non-tipped employees. There is no specific tipped minimum wage for the whole of Connecticut as there are two main rates that feature in the image above.

Related: Connecticut State Minimum Wage

However, all of the state’s tipped employees will have to receive a minimum wage of $15.69 per hour regardless of how much they make in tips, via the tip credit.

Connecticut law requires the Connecticut Department of Labor to calculate a minimum wage increase each year. The annual calculation is based on the percentage increase in the federal Consumer Price Index (CPI) for the previous 12-month period within the state.

The CPI is calculated based on what consumers pay for goods – a 1% increase in the regional CPI translates to a 1% increase in the applicable minimum wage in Connecticut. The minimum wage for both tipped and non-tipped employees rises based on the CPI.

Fair Labor Standards Act (FLSA) and Tipped Employees

The Federal Fair Labor Standards Act, also known as the FLSA, is a federal law from the U.S. Department of Labor.

This law establishes a national minimum wage, defines classifications for employees, and covers other essential standards and requirements for employers.

Federal law requires that employers make tipped employees aware of the cash wage paid (currently, the national direct hourly salary is $2.13 per hour), let them know about the tip credit, and explain any tip pooling systems at the workplace.

Because Connecticut’s minimum wage rate is higher than the federal minimum wage rate, the state laws supersede the federal regulations.

What Does This Mean for My Business?

If you currently operate, are planning on starting a new business in Connecticut, or are considering Connecticut as your new home and are seeking a service and tip-driven job, you should certainly take this information about the Connecticut-tipped minimum wage into account.

While you may want to speak with an employment attorney or accounting firm for legal and tax advice about your business, understanding the minimum wage laws for tipped employees can help you make an informed decision.

In Connecticut, much the same as most other U.S. states, tipped jobs are a mainstay of the economy and accessible for those seeking employment given the nature of Connecticut’s eating and drinking out culture.

Today there are over 8,200 eating and drinking establishments in Connecticut, and there are almost 160,000 restaurant and food service jobs in the state.

Most U.S. states and territories require that tipped employees make either the full state minimum wage or a minimum cash wage higher than the FLSA’s requirements.

Regardless of where you locate your business in the U.S., you will likely need to have a pay rate for tipped employees higher than the federal tipped employee rate.

To learn more about tipped employees, you can check out the Department of Labor’s Website on the minimum wage for tipped employees.