The Colorado state minimum wage increased by $0.77 on January 1, 2024, from $13.65 in 2023 to $14.42 per hour in 2024.

This is one of the largest minimum wage increases in Colorado and represents a 5.6% increase from the previous year.

For many people deciding to relocate to Colorado for employment purposes, the minimum wage is certainly an attractive proposition.

Related: Highest State Minimum Wages

If you are a full-time worker being paid the statewide minimum wage, your earnings could be as follows:

- Daily Minimum Wage: $115.36 (based on an 8-hour day).

- Weekly Minimum Wage: $576.80 (based on a 40-hour week).

- Monthly Minimum Wage: $2,499.46 (based on a full-time month).

- Yearly Minimum Wage: $29,993.60 (based on being paid 2080 hours per year).

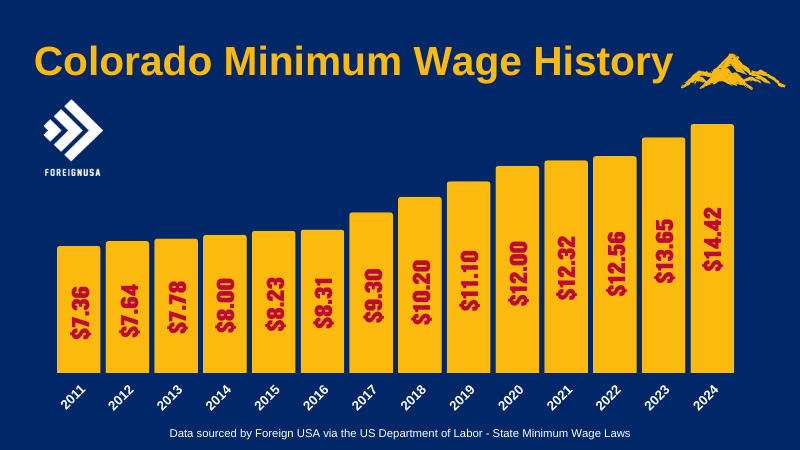

The graphic below highlights the Colorado minimum wage over the past several years.

As you can see, the minimum wage has been increasing on a gradual and steady basis in Colorado, with no real significant increases.

The biggest increase in recent years has been the most recent one.

2024 represents a monumental year for the Colorado state minimum wage, with the wage increasing from $13.65 to $14.42.

Exemptions and Subminimum Wage Rates in Colorado

In addition to the regular minimum wage rate, there are a few exemptions that usually depend on your age or employment situation.

Here is a downloadable graphic showcasing the main minimum wage exemptions in Colorado:

Now, let’s take a look at these minimum wage exemptions in more detail, with some real-life examples to provide more of an understanding.

Colorado Student Minimum Wage

The minimum wage for student employees in Colorado is 85% of the Colorado minimum wage, making their hourly pay $12.25 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible to be paid the Colorado minimum wage rate of $14.42 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying. Despite a student minimum wage rate, many Colorado employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Colorado Under 20 Minimum Wage

If you are under 20 years old in Colorado, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 Colorado minimum wage of $14.42 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Colorado Tipped Minimum Wage

If you are a tipped employee in Colorado (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $11.40 per hour, with a tip credit of $3.02 per hour, ensuring that you reach the statewide minimum wage regardless if you make enough hourly tips.

Related: Colorado Server Minimum Wage

Colorado Overtime Minimum Wage

Once you work over 40 hours a week, you can be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40. So, the overtime Colorado state minimum wage is $21.63 per hour, 1.5 times the minimum wage of $14.42 per hour.

Colorado Employment Types Exempt From Minimum Wage

If you are an employee working under one of the following job roles, you are also exempt from the Colorado minimum wage:

- Executives exemption.

- Administrative exemption.

- Professional exemption.

- Outside salesman exemption.

- Computer employee exemption.

Colorado Minimum Wage Exemptions Table

Below is a table consisting of the Colorado minimum wage exemptions, including some historic rates for reference:

| Colorado Minimum Wage Exemption | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| Tipped Minimum Wage | $11.40 | $10.63 | $9.54 | $9.30 | $8.96 | $8.08 |

| Overtime Minimum Wage | $21.63 | $16.65 | $18.00 | $18.48 | $18.84 | $20.47 |

| Under 20 Minimum Wage | $4.25 | $4.25 | $4.25 | $4.25 | $4.25 | $4.25 |

| Student Minimum Wage | $12.25 | $11.60 | $10.68 | $10.47 | $10.20 | $9.44 |

Colorado Minimum Wage History

The table below shows the history of Colorado’s minimum wage over the years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represented.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $14.42 | $0.77 | 5.64% |

| 2023 | $13.65 | $1.09 | 8.6% |

| 2022 | $12.56 | $0.24 | 1.9% |

| 2021 | $12.32 | $0.32 | 2.7% |

| 2020 | $12.00 | $0.90 | 8.1% |

| 2019 | $11.10 | $0.90 | 8.8% |

| 2018 | $10.20 | $0.90 | 9.6% |

| 2017 | $9.30 | $0.99 | 11.9% |

| 2016 | $8.31 | $0.08 | 0.9% |

| 2015 | $8.23 | $0.23 | 2.8% |

| 2014 | $8.00 | $0.22 | 2.8% |

| 2013 | $7.78 | $0.14 | 1.8% |

| 2012 | $7.64 | $0.28 | 3.8% |

| 2011 | $7.36 | $0.12 | 1.6% |

| 2010 | $7.28 | $0 | 0% |

| 2009 | $7.28 | $0.26 | 3.7% |

| 2008 | $7.02 | $0 | 0% |

| 2007 | $6.15 | $1 | 19.41% |

| 2006 | $5.15 | $0 | 0% |

| 2005 | $5.15 | $0 | 0% |

| 2004 | $5.15 | $0 | 0% |

| 2003 | $5.15 | $0 | 0% |

| 2002 | $5.15 | $0 | 0% |

| 2001 | $5.15 | $0 | 0% |

| 2000 | $5.15 | $0 | 0% |

| 1999 | $5.15 | $0 | 0% |

| 1998 | $5.15 | $0 | 0% |

| 1997 | $5.15 | $0.40 | 8.52% |

| 1996 | $4.75 | $0.50 | 11.76% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0 | 0% |

| 1991 | $4.25 | $0.45 | 11.84% |

| 1990 | $3.80 | $0.45 | 13.43% |

| 1989 | $3.35 | $0 | 0% |

| 1988 | $3.35 | $0 | 0% |

| 1987 | $3.35 | $0 | 0% |

| 1986 | $3.35 | $0 | 0% |

| 1985 | $3.35 | $0 | 0% |

| 1984 | $3.35 | $0 | 0% |

| 1983 | $3.35 | $0 | 0% |

Additionally, we have created a Colorado minimum wage history graphic below, and have also included a free downloadable PDF for your convenience that covers the past 15+ years.

Colorado Minimum Wage History – Downloadable PDF

What Does This Mean if You Are a Colorado Employer?

So, what does this mean for Colorado businesses? As a business in Colorado, it is your responsibility to ensure your employees are paid the current minimum wage rate and no less.

Obviously, there are some exemptions that we have discussed previously, but as an employer in Colorado, if you do not pay your workers the minimum wage rate or higher, there could be some legal repercussions.

Colorado Labor Laws Businesses Must Follow

If the law has not been followed by an employer in Colorado, then the Division of Labor Standards may conduct an employer-wide direct investigation of potential violations of the Colorado wage and hour law.

If you are an employee in Colorado and feel like you need to file an individual claim for unpaid wages, you can fill in a Wage and Hour Complaint Form via the official Division of Labor Standards website.

It is important to note that “Pursuant to Colorado Revised Statute 8-4- 101(14)(a) “Wages” or “Compensation” means the following:

- All labor or services that have been performed by employees, whether it is fixed or ascertained by the standard of time, task, piece, commission basis, or other method used, or alternatively, labor or services performed under contract, subcontract, partnership, sub-partnership, station plan, or other agreement for the performance of labor/service if the labor or service to be paid for is done so personally by the person demanding payment. No amount of money is considered wages or compensation until the mentioned amount has been earned, vested, and determinable, at which time the amount is to be payable to the employee pursuant to this article.

- Both bonuses and commissions earned through labor or services in accordance with the terms of any agreement between the employer and employee.

- Vacation pay that has been earned under the terms of any agreement. If an employer provides paid vacation for an employee, the employer must pay upon separation from employment all vacation pay earned and determinable in accordance with the terms of any agreement that takes place between both the employee and employer.

- Paid sick leave.

- Wages or compensation does not include severance pay.

Now, here is a list of payment issues linked to employment that the Department of Labor and Employment will review:

- Bounced Checks

- Bonuses and commissions

- Compensatory (Comp) Time

- Deductions from Pay

- Final Pay

- Methods of payment

- Overtime

- Pay periods, statements, and paydays

- Piece-rate

- Tipped Employee Wages

- Vacation pay

Here are payment issues that the Department of Labor and Employment will certainly not review:

- Bankruptcy and insolvency

- Holiday pay/leave

- Jury duty

- Retirement plans

- Severance pay

- Wages earned outside the state of Colorado

Colorado Labor Law Poster and Department of Labor and Employment Contact Details

You can view and download the Colorado minimum wage labor law poster for 2024 here at no charge.

Employers must display an official poster outlining the requirements of the Fair Labor Standards Act (FLSA), ensuring that accurate employee time and pay records are kept.

For further information about the Colorado state minimum wage and the records, you must keep as an employer in the state of Colorado, head over to the Colorado Department of Labor and Employment website.

Colorado Department of Labor and Employment Details:

633 17th Street, Suite 201

Denver, CO 80202-3660

Phone: 303-318-8000

Email: cdle_lmi@state.co.us