In November 2022, the inflation rate in the U.S. increased by 0.1% from the previous month, representing an increase of 7.1% over the past twelve months.

The November 2022 Consumer Price Index (CPI) for the U.S. is 297.711. A year ago, in November 2021, the CPI was 277.948. While the inflation rate has increased, the growth rate has slowed as it increased on a month-to-month basis of 7.7% in October 2022.

If you want to learn more about the inflation rate in the US, how it is calculated and measured, and the historic inflation rate over the past 20+ years, we have a detailed article that charts the yearly and monthly rates.

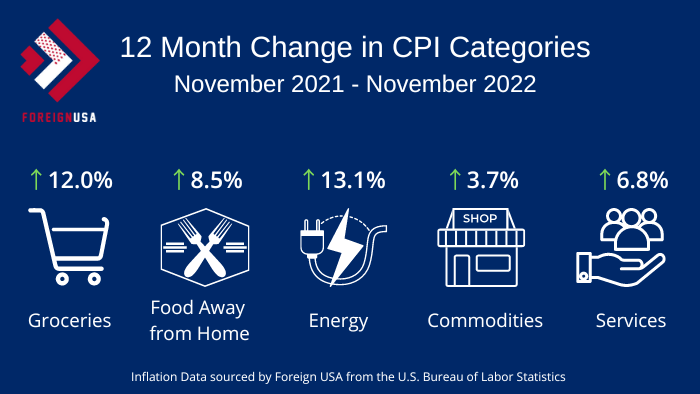

Yearly Inflation Increases by Category

The major inflation categories and their 12-month change for November 2022 include the following:

- Food at Home (Groceries): 12.0% increase

- Food Away from Home (Dining Out): 8.5% increase

- Energy: 13.1% increase

- Commodities (less food and energy commodities): 3.7% increase

- Services (less energy services): 6.8% increase

These cost of living increases reported by the U.S. Bureau of Labor Statistics (BLS) highlight the year-over-year increase in the CPI.

November 2022 Monthly Inflation Increases

On a monthly basis, the increase from October 2022 inflation to November 2022 for the one-month period is as follows:

- Food at Home (Groceries): 0.5% increase

- Food Away from Home (Dining Out): 0.5% increase

- Energy Prices: -1.6% decrease

- Commodities (less food and energy commodities): 0.5% decrease

- Services (less energy services): 0.4% increase

The graphic below breaks down the November 2022 US inflation rate showing the 12-month increase from November 2021 to November 2022, the one-month inflation rate increase from October 2022 to November 2022, and what the inflation rate was this time last year.

Factors that Drove US Inflation in November 2022

Some of the key factors that drove the increase in the inflation rate for November include:

- Interest Rate Hikes: The Federal Reserve Bank (the central bank of the United States, also known as the Fed) is widely expected to increase the interest rate one last time in 2022 on Wednesday, December 14, 2022. It is expected that an increase of 0.5% will increase the interest rate from 4.25% to 4.5%. This represents a smaller increase than has been seen earlier this year of .75% multiple times in a row. Interest rate hikes are done to curb price increases and are a tactic used to decrease the rate of inflation. The more modest interest rate hike that is expected may be indicative that some of the efforts to curb inflation are successful.

- Fuel Oil/Gas/Energy Prices: Energy prices and gas prices tend to be volatile given the geopolitical complications globally, especially where large quantities of oil and natural gas are extracted. Demand for oil and gas has been falling and commodities experts and traders expect them to continue following. Late in November, the U.S. oil price benchmark, the West Texas Intermediate, fell to $80 a barrel from $90 when the month began. This change in energy prices is reflected in a decrease in that inflation category.

- Food Prices: A key driver of inflation rate increases is the cost increase for food prices. Consumers have not seen much relief in a reduction in grocery store prices, but prices on a handful of items are remaining stable or coming down which is helping to slow growth in this inflation category.

- Supply Chain Issues: The price pressures that supply chain issues can cause drive increases in prices of all goods that require transportation. Costs for logistics are beginning to pull back slightly which is a positive sign for inflation. Transportation costs peaked during the summer, but are in retreat. The Federal Reserve Bank recently noted in their latest monetary policy meeting that an “easing of supply constraints” led to their decision to slow the increase in the inflation rate.

- Medical Care Cost Decreases: While there is still a growing shortage of doctors and medical providers following the stresses of the pandemic on the healthcare system and the growing educational expense in medicine, healthcare costs did decrease by 0.6% from the previous month reflecting changes that can benefit U.S.-based healthcare consumers.

December 2022 Inflation Rate Update

Foreign USA’s December inflation report will be released on January 12, 2023. This update will publicize the current inflation rate over the previous 12 months, ending in December 2022.