Tipping may not be commonplace in other countries around the world but it is incredibly common practice in the United States, with a large number of workers making most of their income through tips.

This is certainly the case in the state of Massachusetts.

Hospitality workers, including restaurant, bar, cafe, hotel, and other service provider employees typically know they will be paid a small hourly wage, which is heavily offset by the addition of tips from customers.

Most service-industry workers in Massachusetts will base most of their take-home pay on tips and rely on them to cover living expenses and other general costs.

So, what makes a Tipped Employee in Massachusetts?

Firstly, the question that is posed very frequently regarding this topic is, what makes a tipped employee?

A tipped employee is someone who earns their wages through tips rather than a fixed salary or higher hourly rate.

Federal law establishes the rules of what is considered a tipped employee vs. a non-tipped employee.

If an employee in Massachusetts receives more than $20 per month in tips, they are considered to be a tipped employee by federal and state standards.

These employees often include workers such as bartenders, and servers in restaurants, cafes, hotels, and others.

The Massachusetts laws surrounding the definition of a tipped employee follow these guidelines.

Tipped Employees and the Tipped Minimum Wage in Massachusetts

To abide by the Massachusetts minimum wage laws, employers must ensure that when including tips, their employees are being paid at the very least the state minimum wage rate set for Massachusetts tipped workers, also known as Massachusetts tipped minimum wage for employees.

If those employees are not making that minimum pay rate, it is then the responsibility of the employer to make up the difference.

There are several different employment law factors that have a direct impact on how Massachusetts employers handle their tipped employees.

Understanding the minimum wage in Massachusetts, the federal laws controlling wages, and how pay and wages work for tipped employees is pivotal if you are already running or considering starting a service-related business with tipped employees.

The current minimum wage in Massachusetts is $15.00 per hour for non-tipped employees.

The tipped minimum wage is $6.75 per hour for tipped employees in Massachusetts. This wage is lower than the statewide minimum wage because employees are expected to make up to or surpass the minimum wage rate by earning tips.

State law requires the Massachusetts Department of Labor Standards to calculate a minimum wage increase each year.

The annual calculation is based on the percentage increase in the state’s Consumer Price Index (CPI) previous 12-month period from when the calculation occurred.

The CPI is calculated based on what consumers pay for goods, house price increases, and other significant financial factors that play a role in the general cost of living within the state. The minimum wage for both tipped and non-tipped employees rises based on the CPI.

You can learn more about the Massachusetts minimum wage, and the factors that go into the annual increases on our minimum wage page.

Fair Labor Standards Act (FLSA) and Tipped Employees

The Federal Fair Labor Standards Act, also known as the FLSA, is a federal law from the U.S. Department of Labor. This law establishes a national minimum wage, defines classifications for employees, and covers other essential standards and requirements for employers.

Federal law requires that employers make tipped employees aware of the cash wage paid (currently, the national direct hourly salary is only $2.13 per hour), let them know about the tip credit, and explain any tip pooling systems at the workplace.

Due to Massachusetts’s minimum wage rate being higher than the federal minimum wage rate, the state laws supersede the federal regulations.

Tipped Employees, Tip Credits, and Other Considerations for Employers in Massachusetts

Since the rules for tipped employees are different than non-tipped employees, there are other ways that employers can calculate the minimum amount earned by a tipped employee. One of these ways, and perhaps the most significant method is through tip credits.

The Massachusetts tip credit is currently $8.25 per hour – this means that employers can claim a $8.25 hourly credit against the tipped employee’s minimum wage.

This credit effectively turns the $15.00 minimum wage into a $6.75 per hour minimum wage that employers must pay to tipped employees no matter how much they earn.

Let’s assume a tipped worker earned less than $8.25 per hour as their tipped wage. In that case, the employer must pay the difference between what they made and the additional $6.25 per hour. This pay is called the minimum cash wage.

A minimum cash wage ensures that tipped employees earn a reasonably consistent wage even if a slow workweek or other downturn occurs where they do not receive sufficient tips.

This regular minimum wage rate ensures that servers and others working tipped roles in Massachusetts that do not make enough with tips can still earn a minimum weekly wage when working full-time of $600.00 ($15 x 40 hours per week).

Massachusetts Tipped Minimum Wage History Table

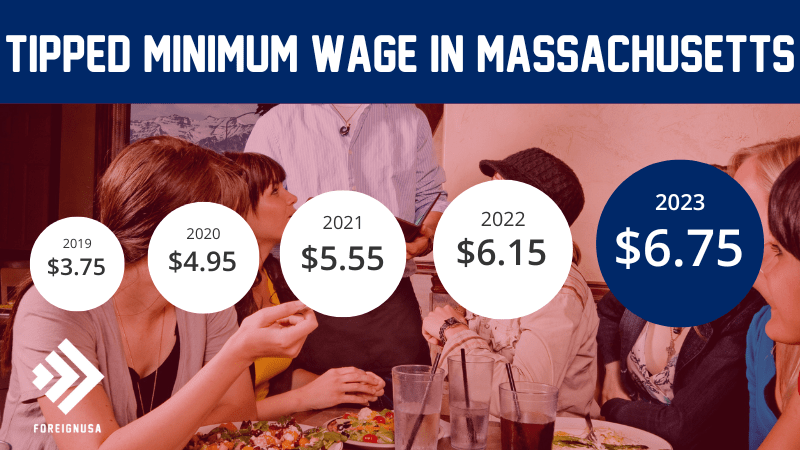

The minimum wage in Massachusetts for tipped employees has been improving almost year on year, much the same as the regular minimum wage.

Below is a historical table that you can use as a reference for the tipped minimum wage in Massachusetts over the years:

| State | Tipped Wage | Tip Credit | Total |

|---|---|---|---|

| Massachusetts tipped minimum wage 2023 | $6.75 | $8.25 | $15.00 |

| Massachusetts tipped minimum wage 2022 | $6.15 | $8.10 | $14.25 |

| Massachusetts tipped minimum wage 2021 | $5.55 | $7.95 | $13.50 |

| Massachusetts tipped minimum wage 2020 | $4.95 | $7.80 | $12.75 |

| Massachusetts tipped minimum wage 2019 | $3.75 | $8.25 | $12.00 |

| Massachusetts tipped minimum wage 2018 | $3.75 | $7.25 | $11.00 |

| Massachusetts tipped minimum wage 2017 | $3.75 | $7.25 | $11.00 |

| Massachusetts tipped minimum wage 2016 | $3.35 | $6.65 | $10.00 |

| Massachusetts tipped minimum wage 2015 | $3.00 | $6.00 | $9.00 |

| Massachusetts tipped minimum wage 2014 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2013 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2012 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2011 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2010 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2009 | $2.63 | $5.37 | $8.00 |

| Massachusetts tipped minimum wage 2008 | $2.63 | $5.37 | $8.00 |

What Does This Mean for My Business?

If you are planning to buy or start a new business in Massachusetts due to the abundance of opportunities the state has to offer, or just simply considering finding a job in Massachusetts, you will need to be aware of the details surrounding the tipped minimum wage in Massachusetts.

While you may want to speak with an employment attorney or accounting firm for legal and tax advice about your business, understanding the minimum wage laws for tipped employees can, and will certainly aid you in making an informed decision about whether or not to start a business in Massachusetts that has tipped employees.

In Massachusetts tipped jobs are a mainstay of the booming economy and accessible for those seeking employment given the tourist-heavy nature, and ever-growing ‘eating out’ culture within the state of Massachusetts.

Tipped Employees (Servers) in Massachusetts

Today there are just over 15,000 eating and drinking establishments in Massachusetts, and there are almost 350,000 restaurant and food service jobs in the Bay State!

Servers are those who provide and serve their customers with food and beverages in a restaurant or similar type of business where food and drinks are brought to the table.

And as part of this service, a server will typically receive tips (gratuities) for doing so. Massachusetts servers usually rely less on their hourly wage and more on the generosity of guests.

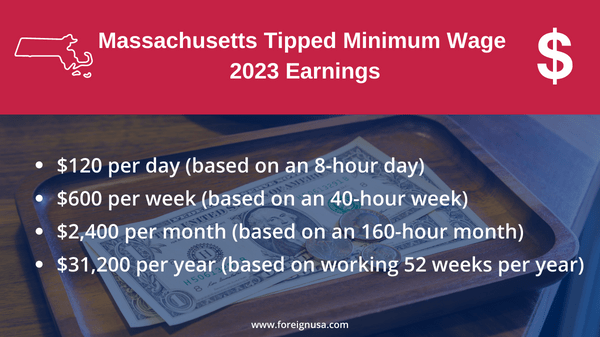

Here is what you can make as a Massachusetts server on the tipped minimum wage in Massachusetts:

- Weekly Server Minimum Wage: $600.00 (based on a 40-hour week).

- Monthly Server Minimum Wage: $2,400 (based on a 160-hour month).

- Yearly Server Minimum Wage: $31,200 (based on being paid 52 weeks per year).

Below is a graphical representation of your potential earnings as a tipped server employee in Massachusetts:

Average Server Salary in Massachusetts for 2023

We have covered the tipped minimum wage that an employer must pay a tipped server employee in Massachusetts. However, what we have not discussed is the average that servers get paid in Massachusetts.

If you are a server or are looking to work as a server in a restaurant or similar business in Massachusetts, knowing the hourly wage for servers is important, but knowing what you can expect to earn is even more important.

Realistically, a lot of Massachusetts servers are not going to take a position at a restaurant with the view that they can only earn $15.00 per hour in totality. They will be looking to earn more and get the most out of their job, financially speaking.

So, the average server hourly wage in Massachusetts (according to the job website Indeed.com) is $17.94 per hour! If you were to work an 8-hour shift or a total of 8 hours in a day across a couple of shifts, you could earn (on average) about $143.52 (8 hrs x $17.94).

This is certainly more lucrative than the standard tipped minimum wage rate in Massachusetts, but you must bear in mind that it is just an average. Some employers will pay more but some will pay less.

It typically depends on how good you are at your job and what kind of restaurant or food service place you are working at.

For example, if you are a server-tipped employee in a fine dining restaurant serving expensive food, you can expect to be paid more than if you worked for a more casual place, serving less lucrative meals.

Final Thoughts and Massachusetts Department of Labor Standards Contact Details

Most U.S. states and territories require that tipped employees make either the full state minimum wage or make a minimum cash wage higher than the FLSA’s requirements.

Regardless of where you locate your business in the U.S., you will most likely need to have a pay rate for tipped employees higher than the federal tipped employee rate.

To learn more about tipped employees in Massachusetts, perhaps what you are owed as an employee, and how much you need to be paying out as an employer, take a look at this useful guide on the laws that come with the state’s minimum wage program.

Provided below is also the contact information and address for the Massachusetts Department of Labor Standards:

Telephone: (617) 626-6952

Email: DLSfeedback@state.ma.us

Address: Department of Labor Standards

100 Cambridge Street, Suite 500

Boston, MA 02114