In 2024, the Massachusetts minimum wage remained the same – $15.00 per hour.

For business owners and those looking to start a business or franchise in Massachusetts, it is important to know about the laws as they relate to employment and the Massachusetts state minimum wage.

If you are a full-time worker on Massachusetts state minimum wage, your earnings could be as follows:

- Weekly Minimum Wage: $600 (based on a 40-hour week).

- Yearly Minimum Wage: $31,200 (based on being paid 52 weeks per year).

- There is an income tax rate in Massachusetts, which will be deducted from your earnings.

A fundamental part of any business is paying wages to employees, and it is essential to be aware of the laws and rules of the state in which you are doing business. Likewise, for employees, it is important to know their rights and what they are entitled to.

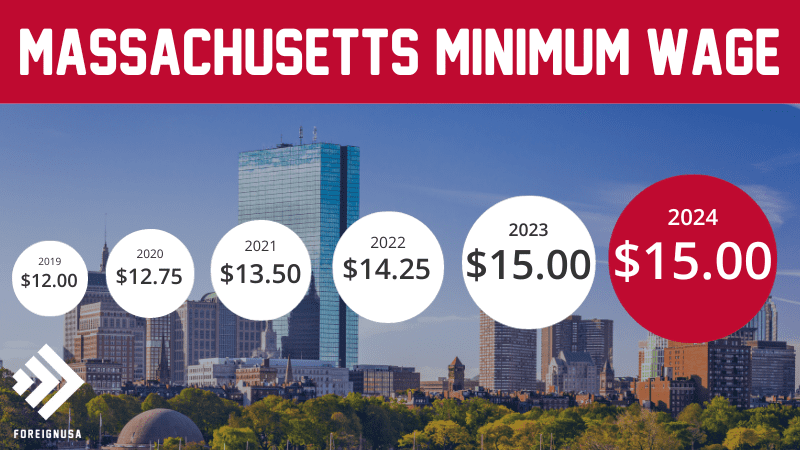

The graphic below highlights the Massachusetts minimum wage over the past several years. As you can see, the minimum wage in Bay State has been steadily increasing over the past several years.

You can view and download the Massachusetts minimum wage labor law poster for 2024 here at no charge. Employers must display an official poster outlining the requirements of the Fair Labor Standards Act (FLSA), ensuring that accurate employee time and pay records are kept.

This information will help employers and employees in Massachusetts be in the know when it comes to what the current Massachusetts state minimum wage is, and also what the past and future minimum wage look like.

This makes the Massachusetts minimum wage one of the highest of all 50 states. If you would like to see the top 10 highest state minimum wage rates by state, then head over to our page that is dedicated to this.

The Massachusetts state minimum wage has always been considered high in comparison with other states, a reason for this is that the minimum wage, much like other states is measured and increased based on the state’s consumer price index.

Massachusetts Minimum Wage Exemptions 2024

Although the state minimum wage is $15 p/h, some counties, cities, or towns may have different minimum wages. For more information regarding minimum wage laws and updates, visit the Massachusetts Government Website.

So, in addition to the regular minimum wage rate, and various location-based minimum wage rates, there are a few Massachusetts state minimum wage exemptions that typically depend on your age or employment situation.

Below are the various minimum wage exemptions with some situational examples.

Massachusetts Student Minimum Wage

The minimum wage for student employees in Massachusetts is 85% of the Massachusetts minimum wage, making their hourly pay $12.75 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible for the Massachusetts minimum wage rate of $15.00 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many Massachusetts employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Massachusetts Under 20 Minimum Wage

If you are under 20 years old in Massachusetts, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 Massachusetts minimum wage of $15.00 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Massachusetts Tipped Minimum Wage

If you are a tipped employee in Massachusetts (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $6.75 per hour, with a tip credit of $8.25 per hour, ensuring that you reach the statewide minimum wage regardless if you make enough hourly tips.

Massachusetts Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40.

So, the overtime minimum wage in Massachusetts is $22.50 per hour, 1.5 times the minimum wage of $15.00 per hour.

Massachusetts Minimum Wage History

The table below shows the current rate and history of Massachusetts’ minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $15.00 | $0 | 0% |

| 2023 | $15.00 | $0.75 | 5.26% |

| 2022 | $14.25 | $0.75 | 5.55% |

| 2021 | $13.50 | $0.75 | 5.88% |

| 2020 | $12.75 | $0.75 | 6.25% |

| 2019 | $12.00 | $1.00 | 9% |

| 2018 | $11.00 | $0 | 0% |

| 2017 | $11.00 | $1.00 | 10% |

| 2016 | $10.00 | $1.00 | 11.1% |

| 2015 | $9.00 | $1.00 | 12.5% |

| 2014 | $8.00 | $0 | 0% |

| 2013 | $8.00 | $0 | 0% |

| 2012 | $8.00 | $0 | 0% |

| 2011 | $8.00 | $0 | 0% |

| 2010 | $8.00 | $0 | 0% |

| 2009 | $8.00 | $0 | 0% |

| 2008 | $8.00 | $0 | 0% |

| 2007 | $7.50 | $0.75 | 11.11% |

| 2006 | $6.75 | $0 | 0% |

| 2005 | $6.75 | $0 | 0% |

| 2004 | $6.75 | $0 | 0% |

| 2003 | $6.75 | $0 | 0% |

| 2002 | $6.75 | $0 | 0% |

| 2001 | $6.75 | $0.75 | 12.5% |

| 2000 | $6.00 | $0.75 | 14.28% |

| 1999 | $5.25 | $0 | 0% |

| 1998 | $5.25 | $0 | 0% |

| 1997 | $5.25 | $0.50 | 11.52% |

| 1996 | $4.75 | $0.50 | 11.76% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0.50 | 13.33% |

| 1991 | $3.75 | $0 | 0% |

| 1990 | $3.75 | $0 | 0% |

| 1989 | $3.75 | $0 | 0% |

| 1988 | $3.75 | $0.10 | 2.73% |

| 1987 | $3.65 | $0.10 | 2.81% |

| 1986 | $3.55 | $0.20 | 5.97% |

| 1985 | $3.35 | $0 | 0% |

| 1984 | $3.35 | $0 | 0% |

| 1983 | $3.35 | $0 | 0% |