The U.S. does not have a fixed rate of corporate income tax that is a one-size-fits-all for every state. Almost every U.S. state has a different rate of corporate income tax.

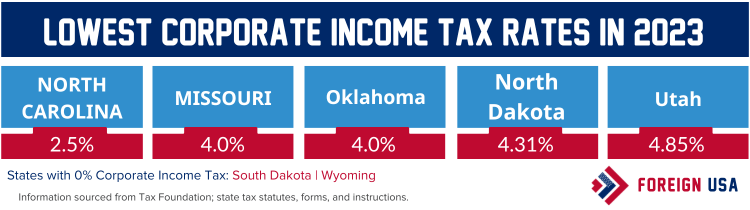

Not all states have one specific fixed rate; they have a progressive rate based on the income (net profit) your business generates at the end of each financial year. The lowest corporate tax rates for 2023 noted below are fixed regardless of the income your business earns.

Lowest Corporate Tax Rates by State for 2023

1. North Carolina: 2.5%

2. Missouri: 4%

3. Oklahoma: 4%

4. North Dakota: 4.31%

5. Utah: 4.85%

It is important to note that there are two states with 0% corporate income tax. However, this does not necessarily mean your business will not be subject to taxation in some form or another. The states with no corporate income tax are South Dakota and Wyoming.

- If you want to jump straight to our table that lists the corporate income tax rates for all 50 states – CLICK HERE

- If you want to jump straight to a downloadable graphic that shows the corporate income tax rates for all 50 states – CLICK HERE

Some states with a 0% corporate income tax rate charge a gross receipts tax, which is not strictly comparable to corporate income tax rates and is based on the total revenue your business generates without subtracting your expenses. So, instead of paying tax on your net profit, you will pay gross receipts tax on your revenue.

Here is an example – If your business collects $500,000 in revenue in 2023, a state may impose a .375% tax rate on it. You must pay $1,875 to the state. Some states, such as Texas, call this a franchise tax.

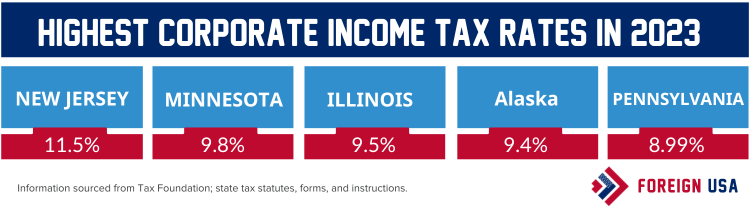

What State Has the Highest Corporate Income Tax Rate?

1. New Jersey: 11.5%

2. Minnesota: 9.8%

3. Illinois: 9.5%

4. Alaska: 9.4%

5. Pennsylvania: 8.99%

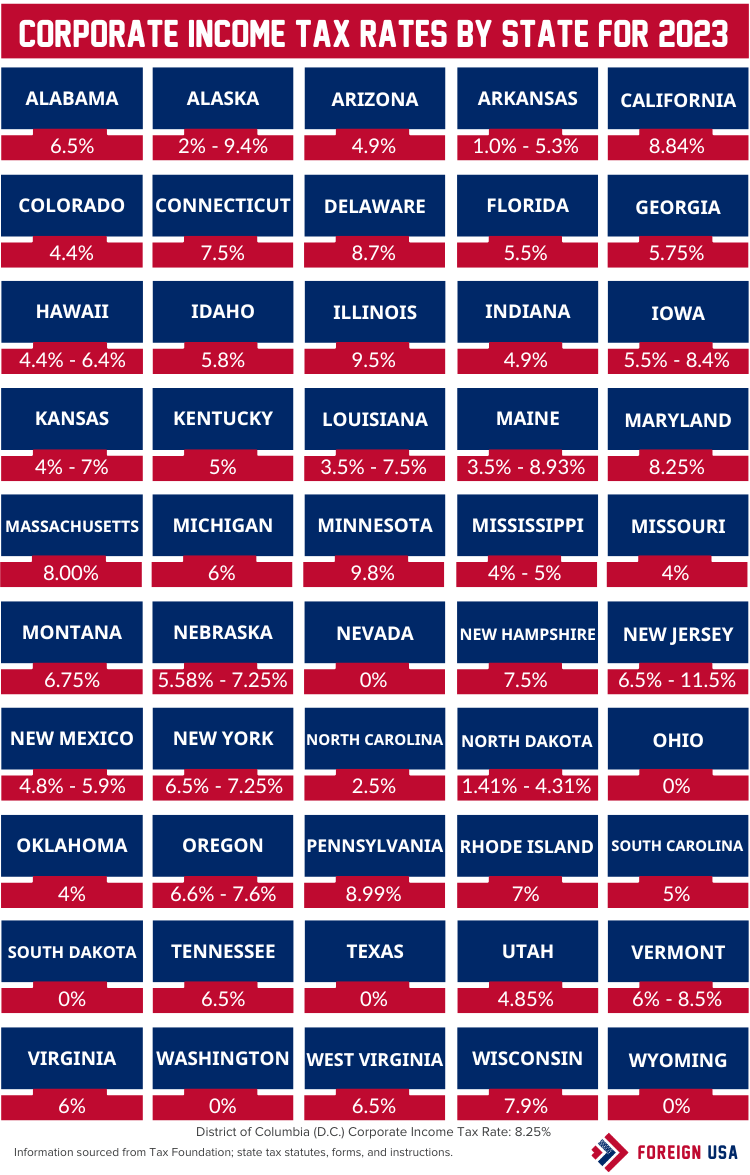

Corporate Tax Rates by State for 2023

Here are the corporate income tax rates by state that show those with a fixed rate, a progressive rate based on how much profit you make, and those that do not charge corporate income tax (0%). Alabama has a fixed rate of 6.5%, so any profit you make you will pay 6.5% corporate income tax on this amount.

Another example on our tax rates table is Alaska where the rate of corporate income tax is progressive and changes based on how much profit your business makes. So, for example, if your profit is more than $25,000 but less than $49,000, you will pay 2% in corporate income tax. If your business makes over $99,000 but less than $124,000, you will pay 5% in corporate income tax.

| State | Rates | Tax Brackets (More Than) |

|---|---|---|

| Alabama Corporate Income Tax Rate | 6.5% | $0 |

| Alaska Corporate Income Tax Rates | 0% | $0 |

| 2% | $25,000 | |

| 3% | $49,000 | |

| 4% | $74,000 | |

| 5% | $99,000 | |

| 6% | $124,000 | |

| 7% | $148,000 | |

| 8% | $173,000 | |

| 9% | $198,000 | |

| 9.4% | $222,000 | |

| Arizona Corporate Income Tax Rate | 4.9% | $0 |

| Arkansas Corporate Income Tax Rates | 1.0% | $0 |

| 2.0% | $3,000 | |

| 3.0% | $6,000 | |

| 5.0% | $11,000 | |

| 5.3% | $25,000 | |

| California Corporate Income Tax Rate | 8.84% | $0 |

| Colorado Corporate Income Tax Rate | 4.4% | $0 |

| Connecticut Corporate Income Tax Rate | 7.5% | $0 |

| Delaware Corporate Income Tax Rate | 8.7% | $0 |

| Florida Corporate Income Tax Rate | 5.5% | $0 |

| Georgia Corporate Income Tax Rate | 5.75% | $0 |

| Hawaii Corporate Income Tax Rates | 4.4% | $0 |

| 5.4% | $25,000 | |

| 6.4% | $100,000 | |

| Idaho Corporate Income Tax Rate | 5.8% | $0 |

| Illinois Corporate Income Tax Rate | 9.5% | $0 |

| Indiana Corporate Income Tax Rate | 4.9% | $0 |

| Iowa Corporate Income Tax Rates | 5.5% | $0 |

| 8.4% | $100,000 | |

| Kansas Corporate Income Tax Rates | 4% | $0 |

| 7% | $50,000 | |

| Kentucky Corporate Income Tax Rate | 5% | $0 |

| Louisiana Corporate Income Tax Rates | 3.5% | $0 |

| 5.5% | $50,000 | |

| 7.5% | $150,000 | |

| Maine Corporate Income Tax Rates | 3.50% | $0 |

| 7.93% | $350,000 | |

| 8.33% | $1,050,000 | |

| 8.93% | $3,500,000 | |

| Maryland Corporate Income Tax Rate | 8.25% | $0 |

| Massachusetts Corporate Income Tax Rate | 8.00% | $0 |

| Michigan Corporate Income Tax Rate | 6.00% | $0 |

| Minnesota Corporate Income Tax Rate | 9.8% | $0 |

| Mississippi Corporate Income Tax Rates | 4% | $5,000 |

| 5% | $10,000 | |

| Montana Corporate Income Tax Rate | 6.75% | $0 |

| Nebraska Corporate Income Tax Rates | 5.58% | $0 |

| 7.25% | $100,000 | |

| Nevada Corporate Income Tax Rate | 0% | |

| New Hampshire Corporate Income Tax Rate | 7.5% | $0 |

| New Jersey Corporate Income Tax Rates | 6.5% | $0 |

| 7.5% | $50,000 | |

| 9.0% | $100,000 | |

| 11.5% | $1,000,000 | |

| New Mexico Corporate Income Tax Rates | 4.8% | $0 |

| 5.9% | $500,000 | |

| New York Corporate Income Tax Rate | 6.5% | $0 |

| 7.25% | $5,000,000 | |

| North Carolina Corporate Income Tax Rate | 2.5% | $0 |

| North Dakota Income Tax Rates | 1.41% | $0 |

| 3.55% | $25,000 | |

| 4.31% | $50,000 | |

| Ohio Corporate Income Tax Rate | 0% | |

| Oklahoma Corporate Income Tax Rate | 4% | $0 |

| Oregon Corporate Income Tax Rates | 6.6% | $0 |

| 7.6% | $1,000,000 | |

| Pennsylvania Corporate Income Tax Rate | 8.99% | $0 |

| Rhode Island Corporate Income Tax Rate | 7% | $0 |

| South Carolina Corporate Income Tax Rate | 5% | $0 |

| South Dakota Corporate Income Tax Rate | 0% | |

| Tennessee Corporate Income Tax Rate | 6.5% | $0 |

| Texas Corporate Income Tax Rate | 0% | |

| Utah Corporate Income Tax Rate | 4.85% | $0 |

| Vermont Corporate Income Tax Rates | 6% | $0 |

| 7% | $10,000 | |

| 8.5% | $25,000 | |

| Virginia Corporate Income Tax Rate | 6% | $0 |

| Washington Corporate Income Tax Rate | 0% | |

| Washington D.C. Corporate Income Tax Rate | 8.25% | $0 |

| West Virginia Corporate Income Tax Rate | 6.5% | $0 |

| Wisconsin Corporate Income Tax Rate | 7.9% | $0 |

| Wyoming Corporate Income Tax Rate | 0% |

Corporate Income Tax Rates by State (Downloadable Graphic)

Feel free to download our graphic that shows the fixed, variable, and 0% corporate income tax rates in 2023 for all 50 states and D.C. If you want to include it on your website please link back and reference this page as the source.