If you are a server in Arizona or are considering becoming a server, then you should know what the minimum wage is for servers in Arizona to see if you are being paid the correct amount, or whether this is a job you would like to do.

The Arizona tipped minimum wage for servers acts as a safety net for those who may not earn enough in tips to meet the minimum wage threshold in the state.

Servers are those who provide and serve their customers with food and beverages in a restaurant or similar type of business where food and drinks are brought to the table, and as part of this service, a server will typically receive tips (gratuities) for doing so.

Arizona servers typically will rely less on their hourly wage and more on the generosity of guests to make up a substantial portion of their pay.

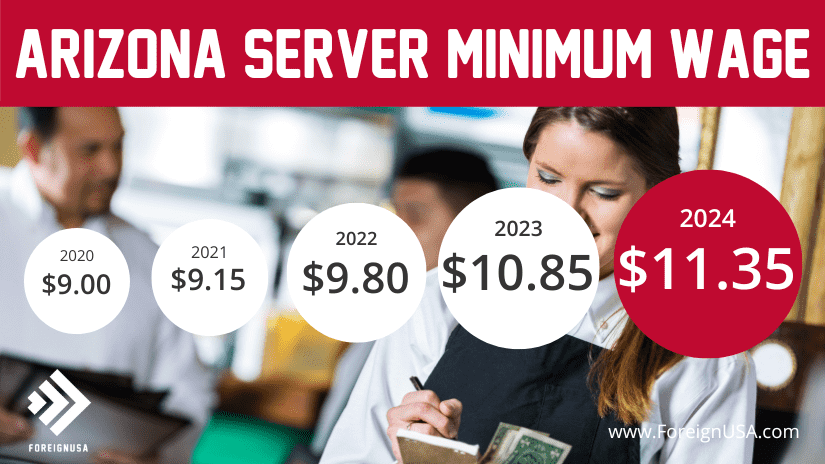

Arizona Server Minimum Wage 2024

So, how much do Arizona servers make? The minimum cash wage for servers and waiters/waitresses in Arizona is the same as the tipped minimum wage in Arizona, which is $11.35 per hour.

This is the minimum per hour that an Arizona-tipped server must be paid and that an Arizona employer must pay its servers.

$11.35 per hour may not sound like a lot, but it is higher than the Federal minimum wage amount! In addition to the tipped minimum wage, Arizona servers are required to be supplemented by their employers via “tipped credit”, which in Arizona’s case is $3.00 per hour, making the server minimum wage in Arizona a total of $14.35 per hour.

The regular minimum wage in Arizona for all types of employees in Arizona was increased to $14.35 per hour in January 2024.

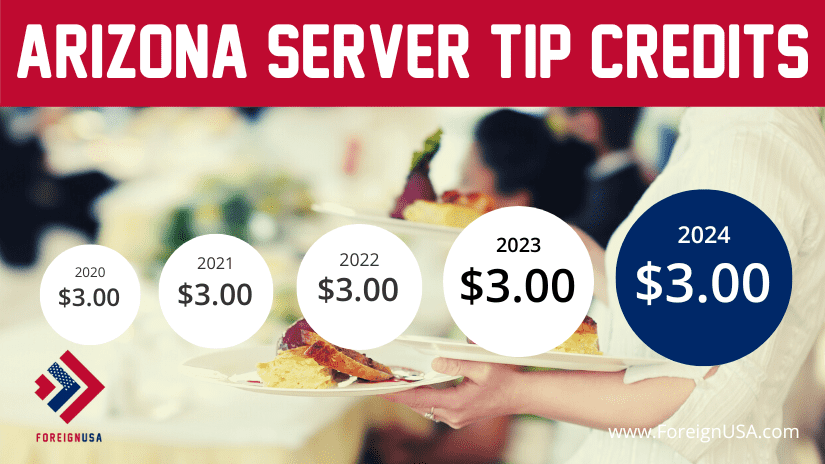

Per the tipped minimum wage laws that apply to all states, Arizona employers are required to pay their employees an hourly minimum cash wage with the addition of tip credits.

What tipped credits allow employers to do is pay tipped employees less than the minimum wage so long as they can make up the difference via tips so they meet or exceed the state’s minimum wage at the end of each pay period.

Tip credit not only allows server employees to be paid less than the minimum hourly wage, but it is also the same concept with bartenders, hotel workers, airport attendants, cruise ship workers, and pretty much any job role where tips are the primary income for the employee.

In Arizona, servers must be paid a base minimum cash wage of $11.35 per hour. The expectation is that Arizona servers will make at least an additional $3.00 per hour in tips on average across their pay period, and if they do, then the employer is only obligated to pay an Arizona server $11.35 per hour.

The graphic below displays the Arizona server tip credit rates over the past several years:

Let’s assume that a server does not make at least $11.35 per hour in tips as an average over the course of their pay period (usually two weeks), then the employer must step in and pay the Arizona server a tip credit of $3.00 per hour, so the server makes a minimum of $14.35 per hour for the duration of the pay period that they worked.

Fair Labor Standards Act (FLSA) and Tipped Employees

The Federal Fair Labor Standards Act, or the FLSA, is a federal law from the U.S. Department of Labor.

This law establishes a national minimum wage, defines classifications for employees, and covers other essential standards and requirements for employers.

Federal law requires that employers make tipped employees aware of the cash wage paid (currently, the national direct hourly salary is only $2.13 per hour), let them know about the tip credit, and explain any tip pooling systems at the workplace.

Due to Arizona’s minimum wage rate being higher than the federal minimum wage rate, the state laws supersede the federal regulations.

Arizona Server Minimum Wage History

The table below showcases the current rate and history of the Arizona server minimum wage over the past 5+ years.

You can see when there were increases in the server minimum wage, which includes not only the tipped (server) minimum wage rates but the tipped credit rates too.

| State | Tipped Wage | Tip Credit | Total |

|---|---|---|---|

| Arizona server minimum wage 2023 | $10.85 | $3.00 | $13.85 |

| Arizona server minimum wage 2022 | $9.80 | $3.00 | $12.80 |

| Arizona server minimum wage 2021 | $9.15 | $3.00 | $12.15 |

| Arizona server minimum wage 2020 | $9.00 | $3.00 | $12.00 |

| Arizona server minimum wage 2019 | $8.00 | $3.00 | $11.00 |

| Arizona server minimum wage 2018 | $7.50 | $3.00 | $10.50 |

| Arizona server minimum wage 2017 | $7.00 | $3.00 | $10.00 |

| Arizona server minimum wage 2016 | $5.05 | $3.00 | $8.05 |

Average Server Salary in Arizona (2024)

We have covered the minimum cash wage that an employer must pay an Arizona server of $11.35 per hour, and we have also detailed the safety net for the server should they not make at least $14.35 per hour with tips by receiving tipped credit of $3.00 per hour.

What we have not discussed is the average that servers get paid in Arizona.

If you are a server or are looking to work as a server in a restaurant or similar business in Arizona, knowing the hourly wage for servers is important, but knowing what you can expect to earn is even more important.

What do tipped servers get paid in Arizona?

The average server hourly wage in Arizona (according to the job website Indeed.com) is $14.38 per hour.

So, if you were to work an 8-hour shift or a total of 8 hours in a day across a couple of shifts, you could earn (on average) about $115.04 (8 hrs x $14.38). If you worked five days per week then you could earn about $575.20 per week.

If you took just two weeks off a year and worked for 50 weeks you could potentially earn $28,760.

If you decided to take 3 weeks off per year, or a total amount of time that was the equivalent of about 3 weeks off, then you could possibly earn 49 x $575.20 = $28,184.80 for the year. This, of course, is before Arizona income tax has been taken out.

The above calculations are just averages to give you an idea of what you can earn as an Arizona server. The most important aspect of how much you can earn will depend on how good you are at your job and what type of food/beverage establishment you work at.

Also, many people who work at restaurants or similar establishments are willing to work more than 40 hours per week so they qualify for overtime pay.

If the average food item on the menu is $10-$15 and the restaurant mainly serves wings, burgers, sandwiches, nachos, fries, and similar snack-style food, then the average check for each guest or table will be much less, and therefore, the percentage tip against the total check will result in you earning less per table you serve and you’ll have to serve many tables during your shift.

On the other hand, if you work at a finer dining restaurant or one that is really busy and serves steak, seafood, and other higher-priced menu and beverage items, then you stand to earn more money as the total check for each table you serve will be that much higher and the percentage tip you receive on a higher check will be that much more. Most of this also depends on how busy the restaurant is and how many servers there are.

Highest Paid Server Job in Arizona

According to Indeed.com, the highest-paid server job in Arizona currently is at Hillstone Restaurant Group. This establishment, on average, pay its servers $25 per hour, which is an extremely good wage for this line of work – over double the average hourly rate in Arizona, and almost triple the server minimum wage in Arizona!

So, here is what you can make if you were on the highest-paid server wage in Arizona:

- $200.00 per day ($25 x 8 hours).

- $1,000.00 per week ($200 x 5 days).

- $4,000.00 per month ($1,000 x 4 weeks).

- $52,000.00 per year ($25 x 2080 hours).

Final Thoughts

Perhaps the most important takeaway from this is that, as an Arizona employer, it is your responsibility to pay your tipped employees a minimum hourly rate + tip credit that equals or surpasses the Arizona minimum wage in the event that your servers do not earn enough to meet the $14.35 per hour threshold. Failing to do so will be breaking federal and state laws.

Equally, it is important that as a server working in Arizona, you know your rights and how much you should be paid with your hourly wage and tip credits.

Suppose you have specific questions about the laws surrounding the minimum wage for servers (tipped employees) from both an employer and employee perspective. In that case, you can contact the Industrial Commission of Arizona.

Additionally, if you are an employee who isn’t being paid what you legally should be, you can file a complaint with them too.