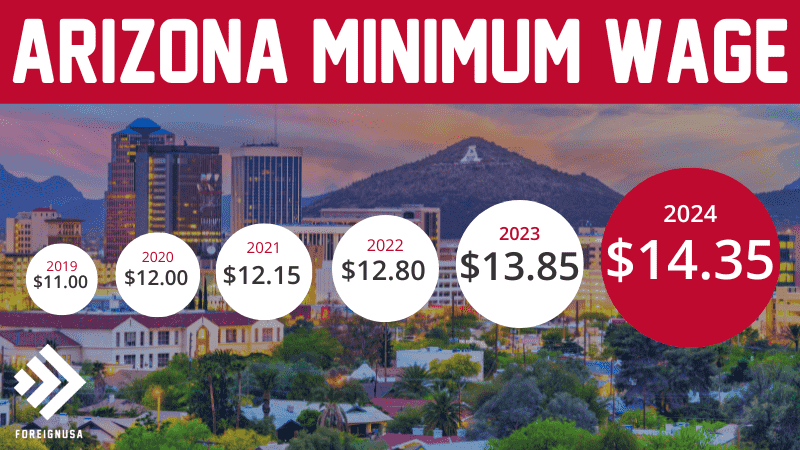

Arizona’s statewide minimum wage rate for 2024 is $14.35 per hour.

This minimum wage is a result of an increase that occurred in January 2024, when the $13.85 per hour rate in 2024 increased by 3.6% in 2024.

Employers in Arizona need to be aware of not only the minimum wage for the state but the laws that surround it too.

Equally, employees in Arizona must know how much they are supposed to be paid and their legal rights as employees within the Grand Canyon State.

So, if you are a full-time worker in Arizona, being paid the state minimum wage, here are what your earnings should look like before any tax has been deducted:

- Daily Minimum Wage: $114.80 (based on an 8-hour day).

- Weekly Minimum Wage: $574.00 (based on a 40-hour week).

- Monthly Minimum Wage: $2,487.33 (based on a 160-hour month).

- Yearly Minimum Wage: $29,848.00 (based on being paid 52 weeks per year).

Arizona is one of many states in the US to have a higher minimum wage rate than the federal minimum wage of $7.25 per hour.

In fact, in 2024, Arizona currently has one of the highest minimum wage rates in the US, ranking 7th in our list.

Related: Highest State Minimum Wage Rates

The minimum wage of $14.35 is calculated via many different measurements, mainly tied to the consumer price index.

In November 2016, Arizona voters approved Proposition 206, the Fair Wages and Healthy Families Act.

This meant that the new minimum wage of $10.00 per hour became effective on January 1st, 2017.

Since then, the minimum wage in Arizona has increased consistently per year in January, as you can see in the downloadable graphic below:

Something else to be aware of is that Arizona does not just have one minimum wage rate for every single employment situation and job role.

There are several minimum wage exemptions that you must know as an employee or employer in Arizona.

Arizona Minimum Wage Exemptions 2024

In addition to the regular minimum wage rate, here are a few exceptions that the Industrial Commission of Arizona Minimum Wage Poster has highlighted.

Below are all of the various minimum wage exemptions with some situational examples.

Arizona Student Minimum Wage

The minimum wage for student employees in Arizona is 85% of the Arizona minimum wage, making their hourly pay $12.20 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible for the Arizona minimum wage rate of $14.35 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many Arizona employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down.

Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Arizona Under 20 Minimum Wage

If you are under 20 years old in Arizona, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 Arizona state minimum wage of $14.35 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Arizona Overtime Minimum Wage

If you surpass 40 hours in a working week, you are eligible to be paid an overtime rate, which consists of 1.5 times the pre-existing minimum wage rate.

In Arizona’s case, once you surpass 40 hours in a working week, you must be paid an hourly minimum wage overtime rate of $21.52 per hour for each hour you work past 40.

Other Minimum Wage Exemptions

Here are the last few exemptions to the Arizona state minimum wage:

- Those employed by a parent or sibling.

- Anyone performing babysitting services in the employer’s home on a casual basis.

- Any person employed by the State of Arizona or the US Government.

- Anyone employed by a small business that grosses less than $500,000 in annual revenue is exempt from paying under section 206 (check the Industrial Commission of Arizona Government website if unsure whether your business qualifies).

- For any Arizona employee who receives tips, you will be subject to a tipped minimum wage rate in Arizona, with a tip credit rate equalling the minimum wage in Arizona. For more information, check out our Arizona server minimum wage page.

Related: Arizona Server Minimum Wage

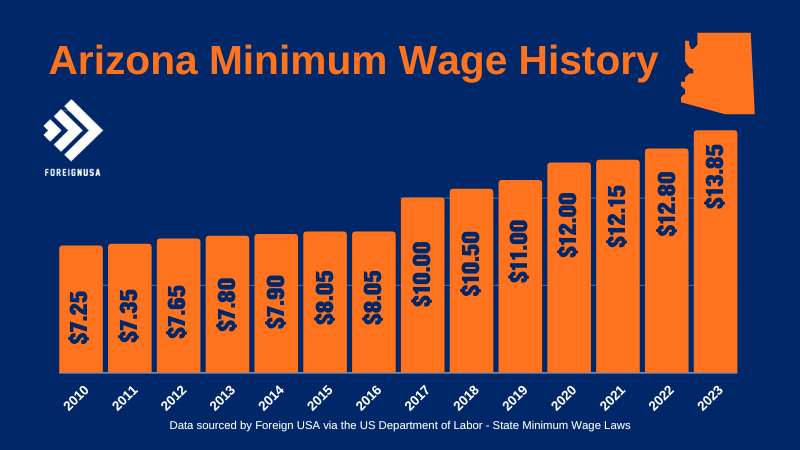

Arizona Minimum Wage History

The table below shows the current rate and history of Arizona’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $14.35 | $0.50 | 3.6% |

| 2023 | $13.85 | $1.10 | 8.2% |

| 2022 | $12.80 | $0.65 | 5.34% |

| 2021 | $12.15 | $0.15 | 1.25% |

| 2020 | $12.00 | $1.00 | 9% |

| 2019 | $11.00 | $0.50 | 4.8% |

| 2018 | $10.50 | $0.50 | 5% |

| 2017 | $10.00 | $1.95 | 24.2% |

| 2016 | $8.05 | $0 | 0% |

| 2015 | $8.05 | $0.15 | 1.9% |

| 2014 | $7.90 | $0.10 | 1.3% |

| 2013 | $7.80 | $0.15 | 1.9% |

| 2012 | $7.65 | $0.30 | 4.1% |

| 2011 | $7.35 | $0.10 | 1.4% |

| 2010 | $7.25 | $0 | 0% |

| 2009 | $7.25 | $0.30 | 4.3% |

| 2008 | $6.90 | $0 | 0% |

| 2007 | $5.85 | $0.70 | 13.59% |

| 2006 | $5.15 | $0 | 0% |

| 2005 | $5.15 | $0 | 0% |

| 2004 | $5.15 | $0 | 0% |

| 2003 | $5.15 | $0 | 0% |

| 2002 | $5.15 | $0 | 0% |

| 2001 | $5.15 | $0 | 0% |

| 2000 | $5.15 | $0 | 0% |

| 1999 | $5.15 | $0 | 0% |

| 1998 | $5.15 | $0 | 0% |

| 1997 | $5.15 | $0.40 | 8.42% |

| 1996 | $4.75 | $0.50 | 11.76% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0 | 0% |

| 1991 | $4.25 | $0.45 | 11.84% |

| 1990 | $3.80 | $0.45 | 13.43% |

| 1989 | $3.35 | $0 | 0% |

| 1988 | $3.35 | $0 | 0% |

| 1987 | $3.35 | $0 | 0% |

| 1986 | $3.35 | $0 | 0% |

| 1985 | $3.35 | $0 | 0% |

| 1984 | $3.35 | $0 | 0% |

| 1983 | $3.35 | $0 | 0% |

Arizona minimum wage history for the past 10+ years – downloadable PDF below

Arizona Minimum Wage History – Downloadable PDF

Arizona Labor Law Poster and Industrial Commission of Arizona Contact Details

As an Arizona employer, you need to keep yourself compliant with the law. To do this, you need to display an Arizona Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Industrial Commission of Arizona website, and download the poster.

If you wish to contact the department directly, here are all of the contact details you need:

Industrial Commission of Arizona

800 W. Washington Street

Phoenix AZ 85007

Telephone: 542-4515

Email: Claims@azica.gov