For business owners and managers, it is essential to know what you are legally obligated to pay your employees – this certainly applies to Oregon.

However, unlike most other states, the minimum wage system in Oregon is pretty different and somewhat complicated.

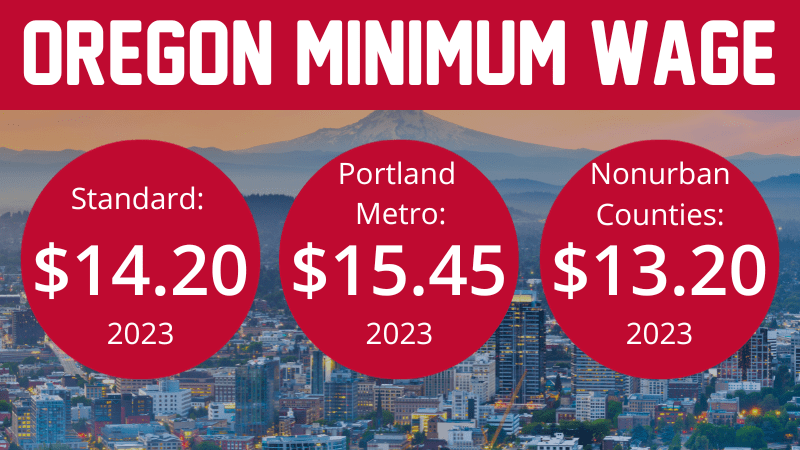

What makes the minimum wage unique in Oregon is that there are three separate rates for three different areas within the state – “Standard”, “Portland Metro”, and “Nonurban Counties”, which are all calculated via the consumer price index.

The consumer price index measures the cost of living, inflation, and other important factors that have a say in determining how much people should be paid.

So, in 2023, here are the different minimum wage rates in Oregon:

- The standard area minimum wage is $14.20 per hour.

- Portland metro area minimum wage is $15.45 per hour.

- Non-urban area minimum wage is $13.45 per hour.

Below is a downloadable graphic featuring these three Oregon state minimum wage rates for your reference:

Oregon’s minimum wage, unlike most states, increases on July 1 of each year, with the standard rate being annually adjusted via the consumer price index.

Now, the other two rates are adjusted and increased in a slightly different manner – each year, the Portland metro area minimum wage will be increased by $1.25 over the standard minimum wage rate, and the non-urban county rates will always be $1 less than the standard minimum wage rate.

So, we will only know what the minimum wage in Oregon for 2024 will be once the standard minimum wage rate has been released.

What Are The Different Minimum Wage Areas?

Now that you are familiar with the different minimum wage rates in Oregon being subject to the different areas, let’s take a look at what these actual areas cover.

So, if you are an employee or employer in one of the following locations, you are covered by the standard minimum wage rate of $14.20 per hour:

- Clatsop

- Columbia

- Tillamook

- Yamhill

- Polk

- Marion

- Lincoln

- Benton

- Linn

- Hood River

- Wasco

- Lane

- Deschutes

- Josephine

- Jackson

Below are the areas covered by the Portland metro area minimum wage rate of $15.45 per hour:

- Washington

- Multnomah

- Clackamas

The non-urban counties in Oregon that are subject to the lowest minimum wage rate in the state of $13.20 per hour – this rate covers the following areas:

- Coos

- Douglas

- Curry

- Klamath

- Lake

- Harney

- Malheur

- Crook

- Grant

- Baker

- Wheeler

- Jefferson

- Wheeler

- Grant

- Baker

- Wallowa

- Union

- Umatilla

- Morrow

- Gilliam

- Sherman

Oregon Minimum Wage History

The table below shows the current rate and history of Oregon’s three minimum wage rates over the past 40+ years since 1983.

| Year | Standard Wage | Portland Metro | Nonurban Counties |

|---|---|---|---|

| 2023 | $14.20 | $15.45 | $13.20 |

| 2022 | $13.50 | $14.75 | $12.50 |

| 2021 | $12.75 | $14.00 | $12.00 |

| 2020 | $12.00 | $13.25 | $11.50 |

| 2019 | $11.25 | $12.50 | $11.00 |

| 2018 | $10.75 | $12.00 | $10.50 |

| 2017 | $10.25 | $11.25 | $10.00 |

| 2016 | $9.75 | $9.75 | $9.50 |

| 2015 | $9.25 | $9.25 | $9.25 |

| 2014 | $9.10 | $9.10 | $9.10 |

| 2013 | $8.95 | $8.95 | $8.95 |

| 2012 | $8.80 | $8.80 | $8.80 |

| 2011 | $8.50 | $8.50 | $8.50 |

| 2010 | $8.40 | $8.40 | $8.40 |

| 2009 | $8.40 | $8.40 | $8.40 |

| 2008 | $7.95 | $7.95 | $7.95 |

| 2007 | $7.80 | $7.80 | $7.80 |

| 2006 | $7.50 | $7.50 | $7.50 |

| 2005 | $7.25 | $7.25 | $7.25 |

| 2004 | $7.05 | $7.05 | $7.05 |

| 2003 | $6.90 | $6.90 | $6.90 |

| 2002 | $6.50 | $6.50 | $6.50 |

| 2001 | $6.50 | $6.50 | $6.50 |

| 2000 | $6.50 | $6.50 | $6.50 |

| 1999 | $6.50 | $6.50 | $6.50 |

| 1998 | $6.50 | $6.50 | $6.50 |

| 1997 | $5.50 | $5.50 | $5.50 |

| 1996 | $4.75 | $4.75 | $4.75 |

| 1995 | $4.75 | $4.75 | $4.75 |

| 1994 | $4.75 | $4.75 | $4.75 |

| 1993 | $4.75 | $4.75 | $4.75 |

| 1992 | $4.75 | $4.75 | $4.75 |

| 1991 | $4.75 | $4.75 | $4.75 |

| 1990 | $4.25 | $4.25 | $4.25 |

| 1989 | $3.85 | $3.85 | $3.85 |

| 1988 | $3.35 | $3.35 | $3.35 |

| 1987 | $3.35 | $3.35 | $3.35 |

| 1986 | $3.35 | $3.35 | $3.35 |

| 1985 | $3.10 | $3.10 | $3.10 |

| 1984 | $3.10 | $3.10 | $3.10 |

| 1983 | $3.10 | $3.10 | $3.10 |

You might be interested to know that the Oregon minimum wage is ranked in the top 10 highest state minimum wages in the United States, which is pretty impressive!

Oregon Bureau of Labor and Industries Contact Details

As an Oregon employer, it is crucial that you familiarize yourself with the law, and remain compliant.

In order to achieve this, you must display an official Oregon Labor Law poster in a prominent place within your business.

The good news is that you can acquire one of these posters for free from the Bureau of Labor and Industries website, and download the poster in seven different languages, English, Arabic, Chinese (Simplified), Chinese (Traditional), Korean, Russian, Spanish, and Vietnamese.

If you wish to contact the bureau directly, here are all of the contact details you need:

Oregon Bureau of Labor and Industries:

800 NE Oregon St, Portland,

OR 97232, USA

Telephone: 971-245-3844

Email: boli_help@boli.oregon.gov

Website