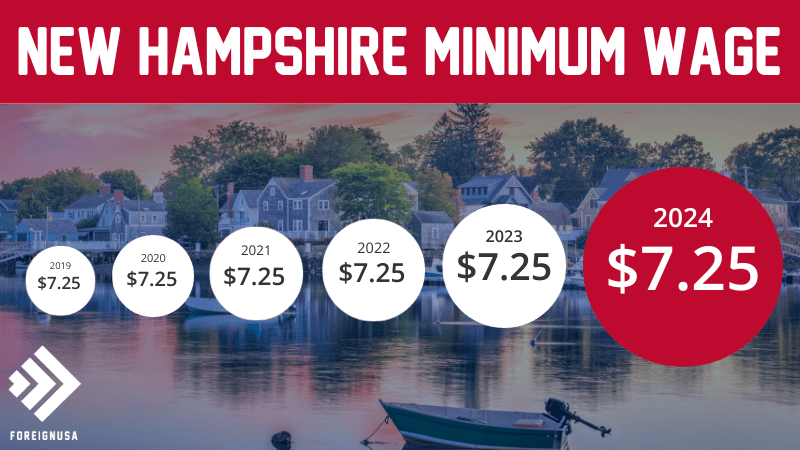

The New Hampshire state minimum wage in January 2024 remains the same as it was last year and in previous years too – $7.25 per hour for state employees, with some exemptions to the rule that are mentioned further down this guide.

For business owners in New Hampshire, it is important to familiarize yourself with the correct and legal wage to pay your employees. Likewise, if you are an employee, you should know your workers’ rights and make sure you are being paid according to New Hampshire state law.

21 states currently align their minimum wage with the federal minimum wage rather than increase it to create their own unique state minimum wage. Unlike the majority of other states, it seems like New Hampshire is not looking to increase its minimum wage any time soon.

Did the New Hampshire Minimum Wage Go Up?

The graphic below highlights the New Hampshire state minimum wage over the past several years. The minimum wage did not go up and remains at $7.25 per hour in 2024.

If you are a full-time worker on minimum wage in New Hampshire, your earnings could be as follows:

- Daily Minimum Wage: $58.00 (based on an 8-hour working day).

- Weekly Minimum Wage: $290.00 (based on a 40-hour week).

- Yearly Minimum Wage: $15,080.00 (based on being paid 52 weeks per year).

New Hampshire has not had a minimum wage increase since before 2008, it has been over 10 years since the state last witnessed an increase to the minimum wage, even though the cost of living is considered quite high.

You can view and download the official New Hampshire minimum wage labor law poster for 2024 here at no charge. Employers must display a poster outlining the requirements of the Fair Labor Standards Act (FLSA), ensuring that accurate employee time and pay records are kept.

To stay up to date with the rules and regulations surrounding the New Hampshire minimum wage, you may want to visit the New Hampshire Department of Labor website. The NH Department of Labor helps employers and insurance carriers operate successfully within New Hampshire’s labor laws. New Hampshire encourages a successful, fair, and safe workplace throughout Granite State.

New Hampshire Min Wage History

The table below shows the current rate and history of New Hampshire’s minimum wage over the past 40+ years since 1983. You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $7.25 | $0 | 0% |

| 2023 | $7.25 | $0 | 0% |

| 2022 | $7.25 | $0 | 0% |

| 2021 | $7.25 | $0 | 0% |

| 2020 | $7.25 | $0 | 0% |

| 2019 | $7.25 | $0 | 0% |

| 2018 | $7.25 | $0 | 0% |

| 2017 | $7.25 | $0 | 0% |

| 2016 | $7.25 | $0 | 0% |

| 2015 | $7.25 | $0 | 0% |

| 2014 | $7.25 | $0 | 0% |

| 2013 | $7.25 | $0 | 0% |

| 2012 | $7.25 | $0 | 0% |

| 2011 | $7.25 | $0 | 0% |

| 2010 | $7.25 | $0 | 0% |

| 2009 | $7.25 | $0 | 0% |

| 2008 | $7.25 | $0 | 0% |

| 2007 | $6.55 | $0.05 | 0.76% |

| 2006 | $6.50 | $1.35 | 26.21% |

| 2005 | $5.15 | $0 | 0% |

| 2004 | $5.15 | $0 | 0% |

| 2003 | $5.15 | $0 | 0% |

| 2002 | $5.15 | $0 | 0% |

| 2001 | $5.15 | $0 | 0% |

| 2000 | $5.15 | $0 | 0% |

| 1999 | $5.15 | $0 | 0% |

| 1998 | $5.15 | $0 | 0% |

| 1997 | $5.15 | $0.40 | 8.42% |

| 1996 | $4.75 | $0.50 | 11.76% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0 | 0% |

| 1991 | $4.25 | $0.50 | 13.33% |

| 1990 | $3.75 | $0.10 | 2.73% |

| 1989 | $3.65 | $0.10 | 2.81% |

| 1988 | $3.55 | $0.10 | 2.89% |

| 1987 | $3.45 | $0.10 | 2.98% |

| 1986 | $3.35 | $0 | 0% |

| 1985 | $3.35 | $0 | 0% |

| 1984 | $3.35 | $0 | 0% |

| 1983 | $3.35 | $0 | 0% |

New Hampshire Minimum Wage Exemptions

In addition to the regular minimum wage rate, there are a few New Hampshire state minimum wage exemptions that typically depend on your age or employment situation. Below are the various minimum wage exemptions with some situational examples.

New Hampshire Student Minimum Wage

The minimum wage for student employees in New Hampshire is 85% of the New Hampshire state minimum wage, making their hourly pay $6.16 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible to be paid the New Hampshire minimum wage rate of $7.25 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying. Despite a student minimum wage rate, many New Hampshire employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

New Hampshire Under 20 Minimum Wage

If you are under 20 years old in New Hampshire, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 New Hampshire minimum wage of $7.25 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

New Hampshire Tipped Minimum Wage

If you are a tipped employee in New Hampshire (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $3.26 per hour, with a tip credit of $3.99 per hour, ensuring that you reach the statewide minimum wage regardless if you make enough hourly tips.

New Hampshire Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40. So, the overtime minimum wage in New Hampshire is $10.88 per hour, 1.5 times the minimum wage of $7.25 per hour.