The statewide minimum wage rate in Illinois is $14.00 per hour in 2024 after a January increase seeing it rise by $1.00 from the previous year.

For Illinois, the minimum wage situation is unique, sharing similar rules to other states because the minimum wage varies depending on where you are located within the state.

Not only do some cities and counties in Illinois have different minimum wage rates, but there are also minimum wage exemptions to be aware of (more about them further down this guide).

As an employer, it is key that you remain up to date on the current and various minimum wage rates across Illinois, ensuring that you are compliant with the laws that surround them.

Equally, as an employee, knowing how much you legally should be getting paid as well as understanding your legal rights as an employee in Illinois is crucial for your employment!

So, as an employee in Illinois being paid the state minimum wage rate – here’s what your earnings will look like:

- Daily Minimum Wage: $112.00 (based on an 8-hour day).

- Weekly Minimum Wage: $560.00 (based on a 40-hour week).

- Monthly Minimum Wage: $2,426.66 (based on a full-time hour month).

- Yearly Minimum Wage: $29,120.00 (based on being paid 2080 hours per year).

It is important to note that these earnings are before any Illinois state income tax has been deducted from your pay.

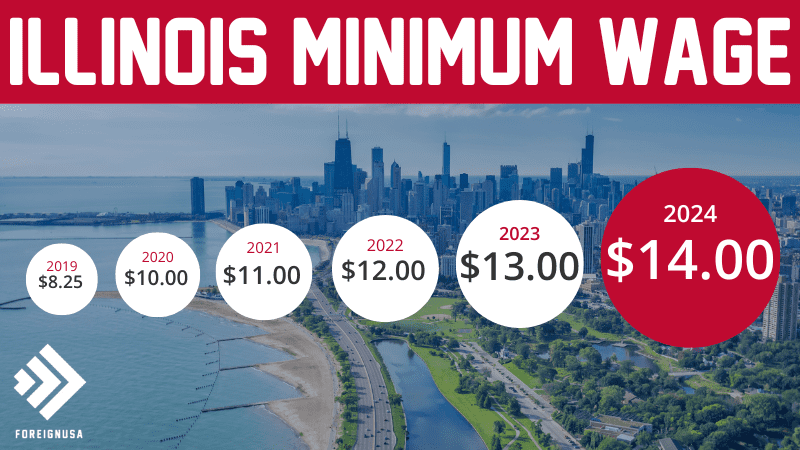

The graphic below highlights the Illinois minimum wage over the past several years:

Unlike a lot of other states, Illinois has released its minimum wage rates for the next few years, providing us with future increases leading up to 2025.

Much like previous years, the state minimum wage is set to increase by $1.00 per year until 2025. This makes the 2024 rate $14.00 per hour and the 2025 rate $15.00 per hour.

Illinois has one of the highest minimum wage rates out of all 50 states – if you would like to learn which state has the highest minimum wage, take a look at our top 10 page on this!

Illinois Minimum Wage Exemptions 2024

In addition to the regular minimum wage rate, there are a few Illinois state minimum wage exemptions that typically depend on your age or employment situation.

There is also a location-dependent minimum wage rate within the state – the Chicago minimum wage.

Below are the various minimum wage exemptions with some situational examples.

Illinois Student Minimum Wage

The minimum wage for student employees in Illinois is 85% of the statewide minimum wage, making their hourly pay $11.90 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible to be paid the Illinois minimum wage rate of $14.00 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many Illinois employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Illinois Under 18 Minimum Wage

If you are under 18 years old in Illinois and work fewer than 650 hours per year then you are subject to a minimum wage rate of $12.00 per hour in 2024.

Once you surpass 650 hours per year as a “young worker” in Illinois, you will be paid the regular minimum wage rate.

Illinois Tipped Minimum Wage

If you are a tipped employee in Illinois (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $7.80 per hour, with a tip credit of $5.20 per hour, ensuring that you reach the statewide minimum wage regardless if you make enough hourly tips.

Illinois Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40. So, the overtime Illinois state minimum wage is $21.00 per hour, 1.5 times the minimum wage of $14.00 per hour.

Illinois Minimum Wage History

The table below shows the current rate and history of Illinois’ minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $14.00 | $1.00 | 7.7% |

| 2023 | $13.00 | $1.00 | 8.3% |

| 2022 | $12.00 | $1.00 | 9% |

| 2021 | $11.00 | $1.00 | 10% |

| 2020 | $10.00 | $0.75 | 8.1% |

| 2020 | $9.25 | $1.00 | 12.1% |

| 2019 | $8.25 | $0 | 0% |

| 2018 | $8.25 | $0 | 0% |

| 2017 | $8.25 | $0 | 0% |

| 2016 | $8.25 | $0 | 0% |

| 2015 | $8.25 | $0 | 0% |

| 2014 | $8.25 | $0 | 0% |

| 2013 | $8.25 | $0 | 0% |

| 2012 | $8.25 | $0 | 0% |

| 2011 | $8.25 | $0 | 0% |

| 2010 | $8.25 | $0.25 | 3.1% |

| 2009 | $8.00 | $0.25 | 3.2% |

| 2008 | $7.75 | $0 | 0% |

| 2007 | $7.50 | $1 | 15.38% |

| 2006 | $6.50 | $0 | 0% |

| 2005 | $6.50 | $1 | 18.18% |

| 2004 | $5.50 | $0.35 | 6.79% |

| 2003 | $5.15 | $0 | 0% |

| 2002 | $5.15 | $0 | 0% |

| 2001 | $5.15 | $0 | 0% |

| 2000 | $5.15 | $0 | 0% |

| 1999 | $5.15 | $0 | 0% |

| 1998 | $5.15 | $0 | 0% |

| 1997 | $5.15 | $0.40 | 8.42% |

| 1996 | $4.75 | $0.50 | 11.76% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0 | 0% |

| 1991 | $4.25 | $0.45 | 11.84% |

| 1990 | $3.80 | $0.45 | 13.43% |

| 1989 | $3.35 | $0 | 0% |

| 1988 | $3.35 | $0 | 0% |

| 1987 | $3.35 | $0 | 0% |

| 1986 | $3.35 | $0 | 0% |

| 1985 | $3.35 | $0.35 | 11.66% |

| 1984 | $3.00 | $0.70 | 30.43% |

| 1983 | $2.30 | $0 | 0% |

Illinois Minimum Wage Poster and Department of Labor Contact Details

As an Illinois employer, you need to keep yourself compliant with the law. To do this, you need to display an Illinois Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Department of Labor website, and download the poster.

If you wish to contact the department directly, here are all of the contact details you need:

Department of Labor

160 N La Salle Dr, Chicago,

IL 60601, USA

Telephone:

Email: DOL.ECA@Illinois.gov