The Hawaii minimum wage in 2024 is currently $14.00 per hour after a January increase.

This was the second statewide minimum wage increase since 2018. Before this year, the minimum wage was $12.00 per hour.

Hawaii’s latest minimum wage represents a $2.00 increase from the 2023 rate, which equates to a 16.66% increase from the previous year.

As an employer in Aloha State, you must be aware of not only the minimum wage rate but also the laws that surround it, ensuring you are compliant and paying your employees correctly.

It is of equal importance as an employee in Hawaii to know what you should be paid at a minimum, and what labor laws apply to you and your employment situation.

If you are a full-time worker on state minimum wage, your earnings could be as follows:

- Daily Minimum Wage: $112.00 (based on an 8-hour working day).

- Weekly Minimum Wage: $560.00 (based on a 40-hour week).

- Monthly Minimum Wage: $2,426.66(based on a 160-hour month).

- Yearly Minimum Wage: $29,120.00 (based on being paid 52 weeks per year).

Something to bear in mind is that these earnings are before any state taxes have been deducted from your pay, such as income tax.

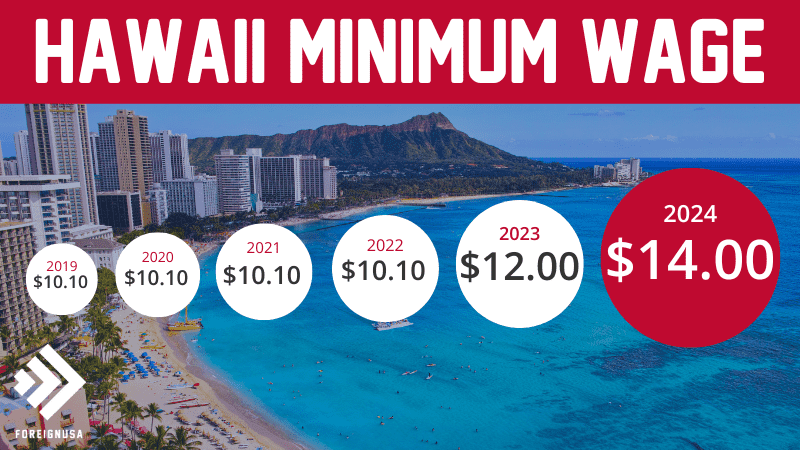

The graphic below highlights the Hawaii state minimum wage over the past several years.

As you can see, in 2024, the people of Hawaii finally saw a minimum wage increase for employees of the state, after having to wait several years for it:

Hawaii Minimum Wage Exemptions

In addition to the regular minimum wage rate, there are a few Hawaii state minimum wage exemptions that typically depend on your age or employment situation.

Below are the various minimum wage exemptions with some situational examples.

Hawaii Student Minimum Wage

The minimum wage for student employees in Hawaii is 85% of the Hawaii minimum wage, making their hourly pay $11.90 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible to be paid the Hawaii minimum wage rate of $14.00 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many Hawaii employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down.

Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Hawaii Under 20 Minimum Wage

If you are under 20 years old in Hawaii, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 Hawaii minimum wage of $14.00 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Hawaii Tipped Minimum Wage

If you are a tipped employee in Hawaii (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $12.75 per hour, with a tip credit of $1.50 per hour, ensuring that you reach the statewide minimum wage regardless if you make enough hourly tips.

Hawaii Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40.

So, the overtime minimum wage in Hawaii is $21.00 per hour, 1.5 times the minimum wage of $14.00 per hour.

Other Exemption Rates in Hawaii

If you work for one of the following industries in Hawaii, you are also exempt from the minimum wage:

- Agriculture.

- United States Government.

- Executive and administrative.

- Computer systems analysts, programmers, software engineers, etc.

- Domestic service.

- Child welfare homes and shelters.

- Ship or vessel work.

- Seasonal youth camp staff sponsored by nonprofit organizations.

- Outside commission-paid sales.

- Fishing, fish processing, propagation, harvesting, and cultivating.

Hawaii Minimum Wage History

The table below shows the current rate and history of Hawaii’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2024 | $14.00 | $2.00 | 16.66% |

| 2023 | $12.00 | $1.90 | 18.8% |

| 2022 | $10.10 | $0 | 0% |

| 2021 | $10.10 | $0 | 0% |

| 2020 | $10.10 | $0 | 0% |

| 2019 | $10.10 | $0 | 0% |

| 2018 | $10.10 | $0.85 | 9% |

| 2017 | $9.25 | $1.25 | 15% |

| 2016 | $8.50 | $1.25 | 17% |

| 2015 | $7.25 | $0 | 0% |

| 2014 | $7.25 | $0 | 0% |

| 2013 | $7.25 | $0 | 0% |

| 2012 | $7.25 | $0 | 0% |

| 2011 | $7.25 | $0 | 0% |

| 2010 | $7.25 | $0 | 0% |

| 2009 | $7.25 | $0 | 0% |

| 2008 | $7.25 | $0 | 0% |

| 2007 | $7.25 | $0.50 | 7.4% |

| 2006 | $6.75 | $0.50 | 8% |

| 2005 | $6.25 | $0 | 0% |

| 2004 | $6.25 | $0 | 0% |

| 2003 | $6.25 | $0.50 | 8.69% |

| 2002 | $5.75 | $0.50 | 9.52% |

| 2001 | $5.25 | $0 | 0% |

| 2000 | $5.25 | $0 | 0% |

| 1999 | $5.25 | $0 | 0% |

| 1998 | $5.25 | $0 | 0% |

| 1997 | $5.25 | $0 | 0% |

| 1996 | $5.25 | $0 | 0% |

| 1995 | $5.25 | $0 | 0% |

| 1994 | $5.25 | $0 | 0% |

| 1993 | $5.25 | $0.50 | 10.52% |

| 1992 | $4.75 | $0.90 | 23.37% |

| 1991 | $3.85 | $0 | 0% |

| 1990 | $3.85 | $0 | 0% |

| 1989 | $3.85 | $0 | 0% |

| 1988 | $3.85 | $0.50 | 14.92% |

| 1987 | $3.35 | $0 | 0% |

| 1986 | $3.35 | $0 | 0% |

| 1985 | $3.35 | $0 | 0% |

| 1984 | $3.35 | $0 | 0% |

| 1983 | $3.35 | $0 | 0% |

Hawaii Labor Law Poster and Department of Labor and Industrial Relations Contact Details

As a Hawaii employer, you need to keep yourself compliant with the law. To do this, you need to display a Hawaii Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Department of Labor and Industrial Relations website, and download the poster.

If you wish to contact the department directly, here are all of the contact details you need:

Department of Labor and Industrial Relations

830 Punchbowl St # 321,

Honolulu, HI 96813, USA

Telephone: +1 808-586-8844

Email: dlir.wages@hawaii.gov