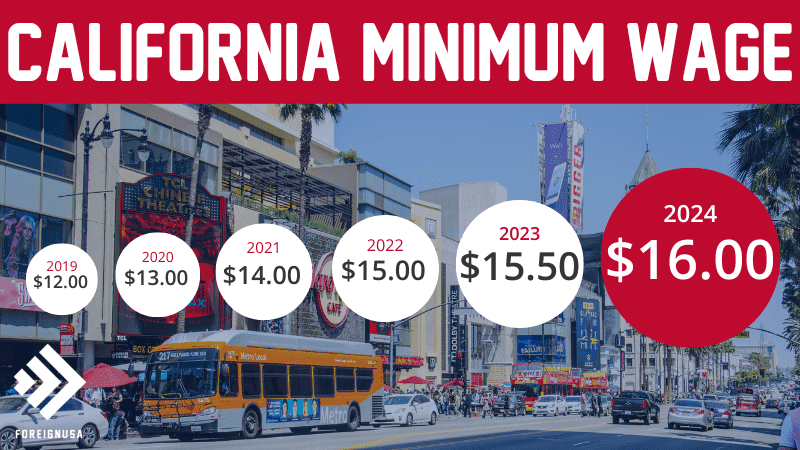

California’s minimum wage in 2024 is $16.00 per hour for all businesses, regardless of the size of them.

The latest minimum wage increase came in January 2024, when it increased from $15.50 to $16.00 per hour, representing a 50-cent or 3.2% increase.

This was due to the enactment of Senate Bill (SB) 3.

California has always had one of the highest minimum wage rates out of all 50 states and this is due to the state’s CPI (Consumer Price Index) being so high.

Related: Highest Minimum Wage States List

As an employer in California, you must understand the minimum wage rate and the laws that go along with it, ensuring that you are in total compliance.

Equally, for employees in the Golden State, you need to know how much you are supposed to be paid at a minimum, and your overall rights as a California employee.

Below are the earnings of somebody working in California under the state minimum wage on a full-time basis:

- Daily Minimum Wage: $128.00 (based on an 8-hour day).

- Weekly Minimum Wage: $640.00 (based on a 40-hour week).

- Monthly Minimum Wage: $2,773.00 (based on a 160-hour month).

- Yearly Minimum Wage: $33,280.00 (based on being paid 52 weeks per year).

It is important to note that these earnings are before any income tax has been deducted – which is rather high in California compared with other states.

Minimum wage rates for the previous years in California are displayed as small business employee minimum wage at the top, and large business employee minimum wage at the bottom.

The California state minimum wage increase was set to be a regular occurrence according to the California Department of Industrial Relations.

Despite there now being only one state minimum wage rate, there are a few exemptions to the rule that you should be aware of.

California Minimum Wage Exemptions

In addition to the regular minimum wage rate, there are a few California state minimum wage exemptions that typically depend on your age or employment situation.

Below are the various minimum wage exemptions with some situational examples.

California Student Minimum Wage

The minimum wage for student employees in California is 85% of the CA minimum wage, making their hourly pay $13.60 per hour in 2024.

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible for the California minimum wage rate of $15.50 per hour.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying.

Despite a student minimum wage rate, many California employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down.

Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

California Under 20 Minimum Wage

If you are under 20 years old in California, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2024 California minimum wage of $16.00 per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

California Tipped Minimum Wage

Most states have their own unique minimum wage rate and then a tip credit rate on top to ensure the tipped employee receives the minimum wage rate.

However, California does not – all tipped employees in California will be paid the minimum wage rate of $16.00 per hour or more, no more, no less, and no tip credit!

Related: California Server Minimum Wage

California Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40.

So, the overtime California state minimum wage is $24.00 per hour, 1.5 times the minimum wage of $16.00 per hour.

Other California Minimum Wage Exemptions

Here are the rest of the California minimum wage exemptions via employment types and situations:

- Executive workers.

- Administrative employees.

- Professional employees.

- Computer professional employees.

- Salespersons.

- Artist exemptions.

California Minimum Wage History

The table below shows the current rate and history of California’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Wage for employers with 26 employees or more | Wage for employers with 25 employees or less |

|---|---|---|

| 2024 | $16.00 | $16.00 |

| 2023 | $15.50 | $15.50 |

| 2022 | $15.00 | $14.00 |

| 2021 | $14.00 | $13.00 |

| 2020 | $13.00 | $12.00 |

| 2019 | $12.00 | $11.00 |

| 2018 | $11.00 | $10.50 |

| 2017 | $10.50 | $10.00 |

| 2016 | $10.00 | $10.00 |

| 2015 | $9.00 | $9.00 |

| 2014 | $9.00 | $9.00 |

| 2013 | $8.00 | $8.00 |

| 2012 | $8.00 | $8.00 |

| 2011 | $8.00 | $8.00 |

| 2010 | $8.00 | $8.00 |

| 2009 | $8.00 | $8.00 |

| 2008 | $8.00 | $8.00 |

| 2007 | $7.50 | $7.50 |

| 2006 | $6.75 | $6.75 |

| 2005 | $6.75 | $6.75 |

| 2004 | $6.75 | $6.75 |

| 2003 | $6.75 | $6.75 |

| 2002 | $6.75 | $6.75 |

| 2001 | $6.25 | $6.25 |

| 2000 | $6.25 | $6.25 |

| 1999 | $5.75 | $5.75 |

| 1998 | $5.75 | $5.75 |

| 1997 | $5.15 | $5.15 |

| 1996 | $4.75 | $4.75 |

| 1995 | $4.25 | $4.25 |

| 1994 | $4.25 | $4.25 |

| 1993 | $4.25 | $4.25 |

| 1992 | $4.25 | $4.25 |

| 1991 | $4.25 | $4.25 |

| 1990 | $4.25 | $4.25 |

| 1989 | $4.25 | $4.25 |

| 1988 | $4.25 | $4.25 |

| 1987 | $3.35 | $3.35 |

| 1986 | $3.35 | $3.35 |

| 1985 | $3.35 | $3.35 |

| 1984 | $3.35 | $3.35 |

| 1983 | $3.35 | $3.35 |

California Minimum Wage History – Downloadable PDF

California Department of Industrial Relations Minimum Wage Posters and Department Contact Information

As a California employer, you need to keep yourself compliant with the law. To do this, you need to display a California Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Department of Industrial Relations website, and download the poster in English and Spanish.

If you wish to contact the department directly, here are all of the contact details you need:

Department of Industrial Relations

160 Promenade Circle, Suite 300,

Sacramento, CA 95834

Telephone: 833-526-4636

Email: DLSE2@dir.ca.gov