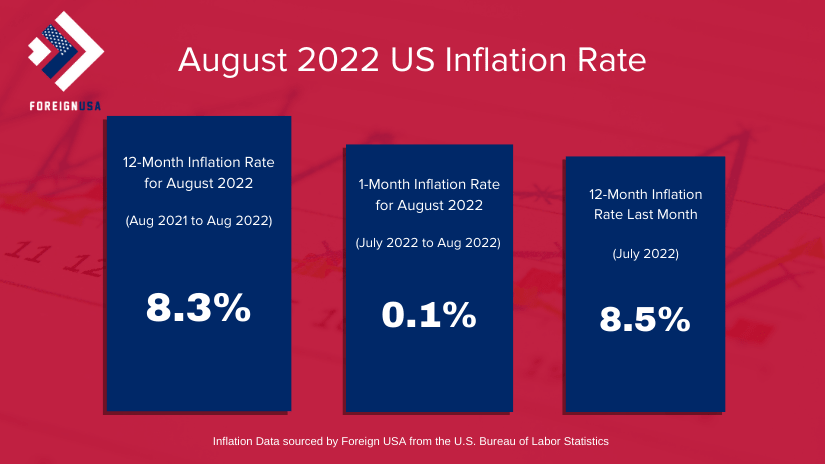

In August 2022, the inflation rate in the U.S. increased by 0.1% from the previous month, representing an increase of 8.3% over the past twelve months.

The August 2022 Consumer Price Index (CPI) for the U.S. is 296.171. A year ago, in August 2021, the CPI was 273.567. This represents a flattening out of the growth of the inflation rate, as it has been unchanged since July 2022. Despite growth flattening, the overall inflation rate has increased starkly over the past year.

If you want to learn more about the inflation rate in the US, how it is calculated and measured, and the historical inflation rate over the past 20+ years, we have a detailed article that charts the yearly and monthly rates.

Yearly Inflation Increases by Category

The major inflation categories and their 12-month change for August 2022 include the following:

- Food – 11.4% increase

- Energy – 23.8% increase

- Commodities (less food and energy commodities) – 7.1% increase

- Services (less energy services) – 6.1% increase

These cost of living increases reported by the U.S. Bureau of Labor Statistics (BLS) highlight the year-over-year increase of the CPI.

August 2022 Monthly Inflation Increases

On a monthly basis, the increase from July 2022 to August 2022 for the one-month period is as follows:

- Food Prices: 0.8% increase

- Energy Prices: -5.0% decrease

- Commodities (less food and energy commodities): 0.5% increase

- Services (less energy services): 0.6% increase

The graphic below breaks down the August 2022 US inflation rate showing the 12-month increase from August 2021 to August 2022, the one-month inflation rate increase from July 2022 to August 2022, and the 12-month inflation rate last month (July 2022).

Factors that Drove US Inflation in August 2022

Some of the key factors that drove the increase in the inflation rate for August include:

- Interest Rate Hikes: The Federal Reserve Bank (the central bank of the United States, also known as the Fed) increased the Federal Funds Rate, also known as the interest rate, from 2.25% to 2.50% at the end of July 2022. This increase in the interest rate is meant to curb price increases, and the use of interest rate hikes is a tactic to decrease the rate of inflation. Given the increase in interest rates and continued inflation, future hikes are likely.

- Fuel Oil/Gas/Energy Prices: Energy prices and gas prices tend to be volatile given the geopolitical complications globally, especially where large quantities of oil and natural gas are extracted. The situation in Ukraine, coupled with OPEC decisions related to oil production, have all impacted the inflation rate in the U.S.

- Food Prices: A key driver of inflation rate increases is the cost increase for food prices. The global availability of wheat exports, which historically come from Ukraine, has also increased food costs. Moreover, the “return to normalcy” following the COVID-19 pandemic has led many consumers to return to dining at restaurants which has increased demand. Given supply chain constraints, that increase in demand is further driving food prices.

- Supply Chain Issues: The price pressures that supply chain issues can cause drive increases in prices of all goods that require transportation. The increase in fuel costs, as well as problems in securing logistics and supply chain labor, can impact the CPI and, subsequently, the inflation rate.

- Medical Care Cost Increases: Americans are seeing an increase in medical care costs, especially given the growing shortage of doctors and medical providers following the stresses of the pandemic on the healthcare system and the growing educational expense.

September 2022 Inflation Rate Update

Foreign USA’s September inflation report was released on October 13, 2022. This update publicizes the current inflation rate over the previous 12 months, ending in September 2022.