Most employees in Ohio who earn an hourly wage and not a fixed salary are entitled to receive a special overtime pay rate for any hours that surpass their 40 hours per week full-time working schedule.

Ohio’s overtime pay, aka “time and a half”, equates to $15.15 per hour for those working for the minimum wage in Ohio (2023).

Some states follow different rules than others when it comes to employee overtime pay. There are some that have a daily overtime limit that allows any employee who works more than a specific number of hours per day to be paid overtime.

Ohio on the other hand does not have a specific daily overtime limit.

Overtime Minimum Wage in Ohio

Overtime in Ohio “time and a half pay” is one and a half times an employee’s regular wage per hour. Ohio’s overtime minimum wage is $15.15 per hour, which is one and a half times the current regular minimum wage rate of $10.10 per hour.

Alternatively, if you earn more than the minimum wage rate, you may still be entitled to 1.5 times the hourly wage you are regularly paid for the overtime that was worked.

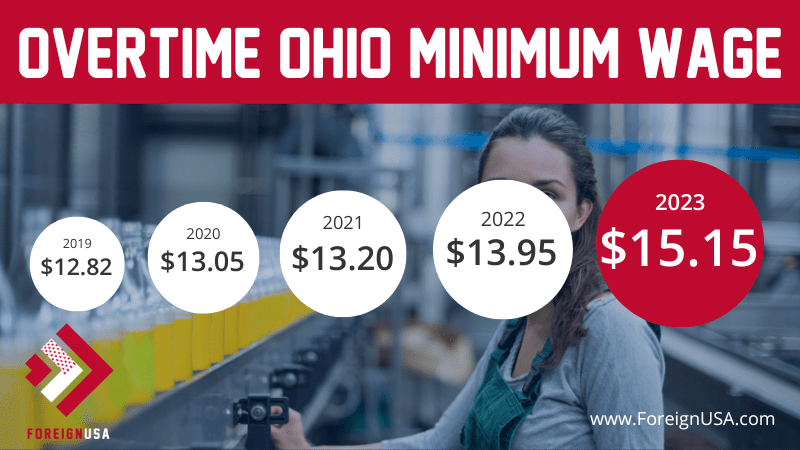

The graphic below displays the overtime pay for minimum wage workers in Ohio over the past several years. Each rate you see is the minimum wage per hour multiplied by 1.5 times.

Unlike most other states, Ohio does not have any specific overtime rules regarding employment and employees – literally, all employees in the state who earn a wage are eligible for overtime pay should they surpass 40 hours in a working week.

Can I Be Paid Overtime Pay In Ohio?

As a general rule in Ohio, if you are paid hourly, earn less than $455 per week ($23,660 annually), and work in a non-exempt industry then you are likely to be eligible to receive overtime pay, should your weekly hours surpass 40.

There are many instances where this may happen, for example, working as a full-time server in Ohio, you might only be down to work 5 days a week in your restaurant, but if a fellow employee is sick that was supposed to work on your day off, then you could be asked to work that day or evening too.

This will likely push your hours over 40 for the week, and therefore, make you eligible for overtime pay.

Is overtime after 8 hours or 40 hours in Ohio?

In Ohio, you will be paid an overtime rate for surpassing 40 hours per week not necessarily for exceeding 8 hours in a given day.

In some other states, this is not the case, you will be paid overtime for working over 8 hours per day, but not in Ohio.

The Buckeye State requires over 40 hours per week for you to be eligible for time and a half pay and not over 8 hours per day.

FLSA Ohio

It is the Fair Labor Standards Act (FLSA) that automatically qualifies workers who meet overtime pay requirements in order for them to receive the overtime pay rate for working over a 40-hour week or daily overtime limits set by Ohio overtime laws.

The FLSA explicitly protects employees in Ohio from all sorts of work-related issues, from being unlawfully punished by an employer for filing any complaints with threats, suspension, or firing.

Remember, in Ohio, there are no employment exemptions when it comes to being paid overtime pay, you can be in any industry, and as long as you are paid hourly, you can apply for overtime pay.

It can be easy to be exploited by your employer, especially if you work in a highly demanding job that will undoubtedly require extra hours to be worked.

By covering all Ohio employees, the FLSA should be contacted immediately if your employer is breaching these laws.

Final Thoughts

If you are in a job where you are paid an hourly wage, then you are eligible and should be paid “time and a half” for every additional hour you work that exceeds 40 hours per week.

Ohio has a Department of Labor Wage and Hour Division, which oversees unemployment compensation and claims for those workers who are not being paid their time and a half after working over 40 hours a week.

Should you wish to contact them, here are the details:

Cleveland Area Office

US Dept. of Labor Wage Hour Division Federal Office Building

1240 E. 9th Street, Room 817

Cleveland, OH 44199-2054

(216) 357-5400

Cincinnati Area Office

US Dept. of Labor Wage & Hour Division

550 Main Street Room 10-409

Cincinnati, OH 45202-5208

(513) 684-2908

Columbus District Office

US Dept. of Labor Wage & Hour Division

200 North High Street, Room 646

Columbus, OH 43215-2408

(614) 469-5678