On July 1, 2023, the statewide minimum wage in Nevada increased to $11.25 per hour for employees who are not offered qualifying health insurance, and to $10.25 per hour for employees do receive qualifying health insurance.

Nevada has a pretty unique system when it comes to the minimum wage. With annual increases taking place on July 1 rather than January 1, and also two different rates being offered depending on employment privileges.

In the past, Nevada hasn’t been known to increase its minimum wage rate often. In fact, the 2023 increase signifies only the 4th increase to the statewide minimum wage rate since 2010.

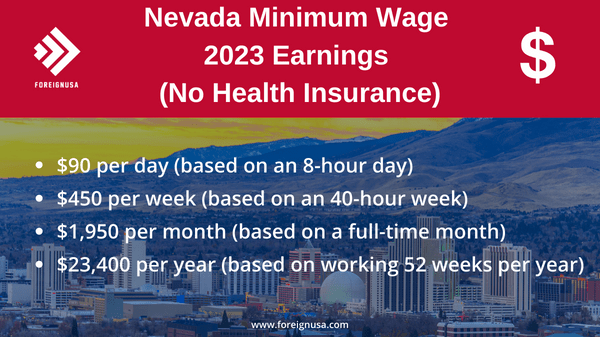

Here are your earnings if you are being paid the $11.25 minimum wage rate (not covered by health insurance):

- Daily Minimum Wage: $90.00 (based on an 8-hour day).

- Weekly Minimum Wage: $450.00 (based on a 40-hour week).

- Monthly Minimum Wage: $1,950.00 (based on a full-time month).

- Yearly Minimum Wage: $23,400.00 (based on being paid 52 weeks per year).

Below are your earnings if you are to be paid the $10.25 per hour minimum wage rate (covered by health insurance):

- Daily Minimum Wage: $82.00 (based on an 8-hour day).

- Weekly Minimum Wage: $410.00 (based on a 40-hour week).

- Monthly Minimum Wage: $1,776.66 (based on a full-time month).

- Yearly Minimum Wage: $21,320.00 (based on being paid 52 weeks per year).

The minimum wage is calculated via the Consumer Price Index, which accounts for the cost of pretty much everything, including the cost of living, house prices, groceries, eating out, and many more things.

Depending on the percentage increase in the CPI, some states match the CPI rate with their minimum wage, some states have a lower minimum wage compared to their CPI, whilst others will increase their minimum wage by much more.

Below is a downloadable graphic for your reference, detailing the statewide minimum wage rates over the past few years, with increases taking place in 2021, 2022, 2023, and some of 2024:

Nevada Minimum Wage Exemptions

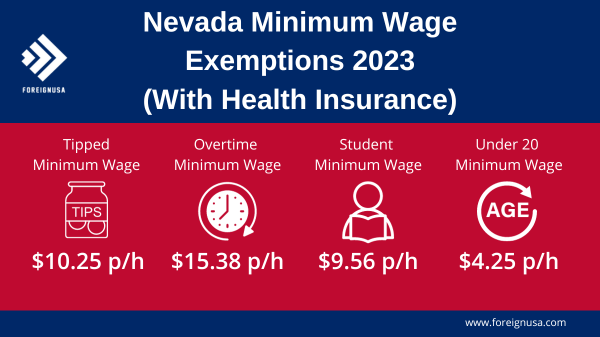

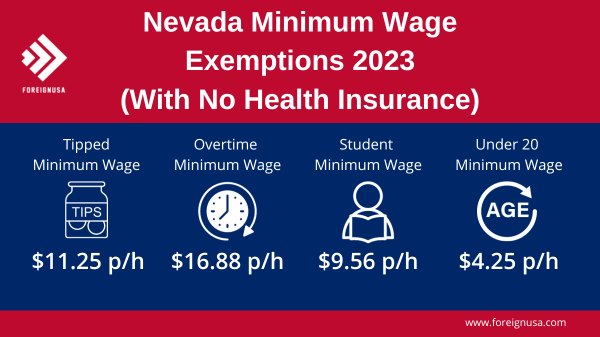

In addition to the regular minimum wage rate, there are a few minimum wage exemptions that typically depend on your age or employment situation.

The graphic below displays the main minimum wage exemptions for those employees covered by health insurance:

This graphic shows you the main minimum wage exemption rates for employees who are not covered by health insurance:

Below are the various minimum wage exemptions with some situational examples.

Nevada Student Minimum Wage

The student minimum wage for those without health insurance is $9.56 per hour (85% of the minimum wage) and for those with health insurance, the student minimum wage is $8.71 (85% of the minimum wage).

This hourly rate is for any hours worked up to 20 hours per week. As a student employee, once you surpass 20 hours per week, you will be eligible for the regular minimum wage rate depending on your health insurance situation.

Being a student can be financially challenging, leading many students to pick up part-time jobs to make extra money while studying. Despite a student minimum wage rate, many Nevada employers will not necessarily follow it and pay you equal to or more than the statewide minimum wage.

Many work-study programs are available at universities, which is a route many students go down. Still, coffee shop, cafe, bar, and restaurant jobs are commonly taken by students as they can work them into their class schedule.

Nevada Under 20 Minimum Wage

If you are under 20 years old in Nevada, federal law allows your employer to pay you as little as $4.25 per hour for your first 90 days of employment.

Once the 90-day period is over, you will be eligible to be paid the 2023 Nevada minimum wage per hour or potentially even more.

Fortunately for young workers, this is 90 calendar days and not 90 working days; therefore, it can be completed relatively quickly and within about three months.

Nevada Tipped Minimum Wage

If you are a tipped employee in Nevada (someone who receives regular tips as a part of their job) then you are eligible to be paid a minimum wage of $11.25 if you do not receive health benefits from your employer, or $10.25 per hour if you do.

Nevada Overtime Minimum Wage

Once you work over 40 hours a week, you are eligible to be paid an overtime rate of 1.5 times your hourly wage for every hour you work past 40.

So, the overtime minimum wage for those with health insurance is $15.38 per hour and $16.88 per hour for employees without health insurance.

Nevada Employment Types Exempt From Minimum Wage

If you are an employee working under one of the following job roles, you are also exempt from the Nevada minimum wage:

- White-collar employees (bona fide executives, administrative workers, and professionals).

- Independent contractors.

- Casual babysitters.

- Outside salespeople, provided their earnings are based on commissions.

- Domestic service employees who reside in the household.

- Agricultural workers.

- Taxicab and limousine drivers.

Nevada Minimum Wage History

The table below shows the current rate and history of Nevada’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage, how much they were, and what percentage increase it represents each year.

| Year | Minimum Wage | Increase ($) | Increase (%) |

|---|---|---|---|

| 2023 | $11.25 | $0.75 | 7.14% |

| 2022 | $10.50 | $0.75 | 7.69% |

| 2021 | $9.75 | $0.75 | 8.3% |

| 2020 | $9.00 | $0.75 | 9% |

| 2019 | $8.25 | $0 | 0% |

| 2018 | $8.25 | $0 | 0% |

| 2017 | $8.25 | $0 | 0% |

| 2016 | $8.25 | $0 | 0% |

| 2015 | $8.25 | $0 | 0% |

| 2014 | $8.25 | $0 | 0% |

| 2013 | $8.25 | $0 | 0% |

| 2012 | $8.25 | $0 | 0% |

| 2011 | $8.25 | $0 | 0% |

| 2010 | $8.25 | $0.70 | 9.3% |

| 2009 | $7.55 | $0.70 | 10.2% |

| 2008 | $6.85 | $0.70 | 11.38% |

| 2007 | $6.15 | $0 | 0% |

| 2006 | $6.15 | $1.00 | 19.41% |

| 2005 | $5.15 | $0 | 0% |

| 2004 | $5.15 | $0 | 0% |

| 2003 | $5.15 | $0 | 0% |

| 2002 | $5.15 | $0 | 0% |

| 2001 | $5.15 | $0 | 0% |

| 2000 | $5.15 | $0 | 0% |

| 1999 | $5.15 | $0 | 0% |

| 1998 | $5.15 | $0 | 0% |

| 1997 | $5.15 | $0.90 | 21.17% |

| 1996 | $4.25 | $0 | 0% |

| 1995 | $4.25 | $0 | 0% |

| 1994 | $4.25 | $0 | 0% |

| 1993 | $4.25 | $0 | 0% |

| 1992 | $4.25 | $0 | 0% |

| 1991 | $4.25 | $0.45 | 11.84% |

| 1990 | $3.80 | $0.45 | 13.43% |

| 1989 | $3.35 | $0 | 0% |

| 1988 | $3.35 | $0 | 0% |

| 1987 | $3.35 | $0.60 | 21.81% |

| 1986 | $2.75 | $0 | 0% |

| 1985 | $2.75 | $0 | 0% |

| 1984 | $2.75 | $0 | 0% |

| 1983 | $2.75 | $0 | 0% |

State of Nevada Department of Business & Industry Office of the Labor Commissioner Contact Details

As a Nevada employer, you need to keep yourself compliant with the law. To do this, you need to display a Nevada annual bulletin in a prominent place.

The good news is that you can acquire one of these bulletins for free from the State of Nevada Office of the Labor Commissioner website, and download the poster in English or Spanish.

Equally, if you’re interested in finding out more about the specific labor laws in Nevada or need more information on overtime or wage disputes, head over to the Nevada Office of the Labor Commissioner website.

If you wish to contact the department directly, here are all of the contact details you need:

Office of the Labor Commissioner

1818 College Parkway, Suite 102

Carson City, NV 89706

Telephone: (775) 684-1890

Email: mail1@labor.nv.gov