Some employees in Mississippi who earn an hourly wage and not a fixed salary are entitled to receive a special overtime pay rate for any hours that surpass their 40 hours per week full-time working schedule.

Mississippi’s overtime pay, aka “time and a half”, equates to $10.88 per hour for those working for the minimum wage in Mississippi (2023).

Some states follow different rules than others when it comes to employee overtime pay. There are some that have a daily overtime limit that allows any employee who works more than a specific number of hours per day (usually 8) to be paid overtime.

Mississippi on the other hand does not have a specific daily overtime limit.

Overtime Minimum Wage in Mississippi

Overtime in Mississippi “time and a half pay” is one and a half times an employee’s regular wage per hour. Mississippi’s overtime minimum wage is $10.88 per hour, which is one and a half times the regular minimum wage rate of $7.25 per hour.

Alternatively, if you earn more than the minimum wage rate, you may still be entitled to 1.5 times the hourly wage you are regularly paid for the overtime hours you work.

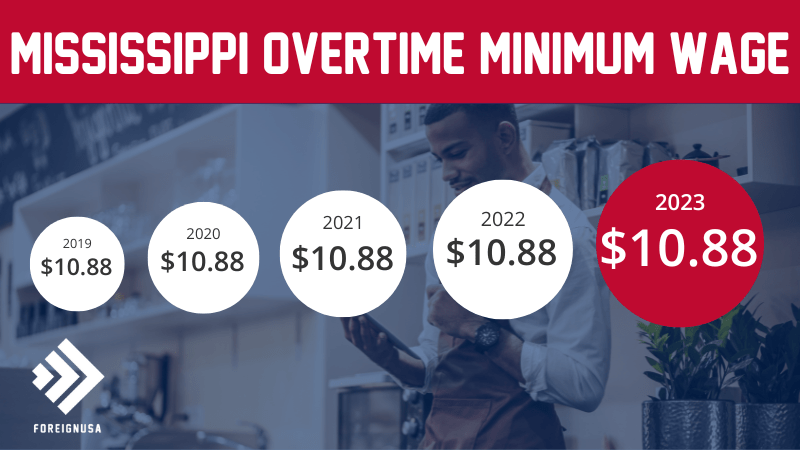

The graphic below displays the overtime pay for minimum wage workers in Mississippi over the past several years. Each rate you see is the minimum wage per hour multiplied by 1.5 times.

As you can see, the overtime rate in relation to the minimum wage has not increased for the past several years.

Can I Be Paid Overtime Pay In Mississippi?

As a general rule in Mississippi, if you are paid hourly, earn less than $455 per week ($23,660 annually), and work in a non-exempt industry then you are likely to be eligible to receive overtime pay, should your weekly hours surpass 40.

There are many instances where this may happen, for example, working as a full-time server in Mississippi (5 days a week, 8 hours per day), you might only be down to work 5 days a week in your restaurant, but if a fellow employee is sick that was supposed to work on your day off, then you could be asked to work that day or evening too.

This will likely push your hours over 40 for the week, and therefore, make you eligible for overtime pay. The scenario could play out in many other types of industries and employers in Mississippi, especially shift work and the covering of other people’s shifts who might be sick or on vacation.

Is overtime after 8 hours or 40 hours in Mississippi?

In Mississippi, you can be paid an overtime rate for surpassing 40 hours per week not necessarily for exceeding 8 hours in a given day.

In some other states, this is not the case, you will be paid overtime for working over 8 hours per day, but not in Mississippi.

The Magnolia State requires over 40 hours per week for you to be eligible for time and a half pay and not over 8 hours per day.

FLSA Mississippi

It is the Fair Labor Standards Act (FLSA) that automatically qualifies workers who are in certain industries that meet overtime pay requirements in order for them to receive the overtime pay rate for working over a 40-hour week or daily overtime limits set by Mississippi overtime laws.

Mississippi follows the FLSA, and if you are in a job that involves manual labor then you undoubtedly are protected under overtime law. There are additional labor laws in place in the state of Mississippi for medical nurses.

Hospitals are not permitted to make a nurse work mandatory overtime hours, however, they can work overtime if they decide to. When it comes to other types of employees, there is no limit on overtime worked.

The main reason why these specific jobs are covered by the FLSA is that they are professional jobs that often lead to long working hours which will more than often lead to more than 40 hours of work per week.

Overtime Exemptions in Mississippi

Overtime laws in Mississippi are in place to prevent workers from employer exploitation when it comes to hourly pay and also the number of hours worked in a given day or week. This mainly refers to those in “blue-collar” jobs who work in demanding fields that will often work far longer than initially intended.

The Fair Labor Standards Act (FLSA) excludes those working as administrators and other professionals who earn at least $455 per week from being paid any overtime. This exemption from the Department of Labor’s regulations can be found under Section 13(a)(1) of the FLSA.

The majority of outside sales employees who set their own hours or work irregular hours are also excluded from the Mississippi overtime laws, as are computer-based workers.

The same goes for independent contractors, transportation workers, certain agricultural and farm workers, and live-in employees like housekeepers.

So, if your job fits into one of the four exemption categories for the Mississippi overtime law (executive, administrative, professional, and outside sales), then you are not protected by state and federal law, and therefore, may not be paid overtime hours.

Executive (Overtime Exemptions)

If your full-time responsibility is managing two or more employees then your job is classed as an “Executive Position”.

If you are in this role then you cannot spend any more than 20% of your time doing other activities (40% in a retail management role), and your job will be salaried (not per hour), with a fixed annual salary that is usually paid bi-weekly (26 pay periods per year) or monthly (12 pay periods per year).

Administrative (Overtime Exemptions)

If your primary tasks at work do not involve manual work and are related to business operations, management policies, and administrative duties then your job is classed as an “Administrative Position”.

If you work in an administrative position then your job must be salaried by law, and you must spend no more than 20% of your time doing activities that are unrelated to your job title (40% in retail roles).

Professional (Overtime Exemptions)

If your job consists of advanced knowledge of a certain industry or profession, that requires extensive education, including arts, certified teachers, skilled computer and tech professionals, then your job is classified as “Professional”.

If you work as a professional, then your job must be salaried and if you spend no more than 20% of your time doing unrelated activities, then you are a professional and therefore are not eligible for overtime pay.

Outside Sales (Overtime Exemptions)

If your main duties are making sales or taking orders outside of an employer’s workplace, then you will likely be paid a salary or a base rate of pay plus commission.

If this is the case then you are in “Outside Sales” and will not be paid an hourly wage, meaning that you will be exempt from overtime pay.

If any of the listed job roles apply to you then unfortunately you will not qualify to receive overtime pay in Mississippi. This means your employer has the right to not pay you extra for working past a full-time working week of 40 hours.

Final Thoughts

If you are in a job where you are paid an hourly wage and do not fall under any of the exemptions, then you may be eligible and should be paid “time and a half” for every additional hour you work that exceeds 40 hours per week.

The Mississippi Department of Employment Security oversees unemployment compensation and claims for those workers who are not being paid their time and a half after working over 40 hours a week.