The statewide minimum wage in Minnesota is divided into two separate rates – one for employees working for large businesses and one for those working for small businesses.

As an employer or employee, it is of equal importance to have a clear understanding of both the minimum wage rate and the laws that apply to it in Minnesota.

Large businesses in Minnesota are employers with an annual gross revenue of over $500,000 – for employees working under these businesses, the 2024 minimum wage is $10.85 per hour.

Now, for small businesses in Minnesota (gross revenue of under $500,000), the minimum wage for employees is $8.85 per hour in 2024.

Let’s take a look at your earnings as an employee being paid the minimum wage working for a large business in Minnesota:

- Daily Minimum Wage: $86.80 (based on an 8-hour day).

- Weekly Minimum Wage: $434.00 (based on a 40-hour week).

- Monthly Minimum Wage: $1,880.66 (based on a 160-hour month).

- Yearly Minimum Wage: $22,568.00 (based on being paid 52 weeks per year).

Now, here are your earnings as a small business employee in Minnesota being paid the minimum wage rate:

- Daily Minimum Wage: $70.80 (based on an 8-hour day).

- Weekly Minimum Wage: $354.00 (based on a 40-hour week).

- Monthly Minimum Wage: $1,534.00 (based on a 160-hour month).

- Yearly Minimum Wage: $18,408.00 (based on being paid 52 weeks per year).

It is also important to note that all the earnings mentioned above are before any state taxes have been deducted from the pay.

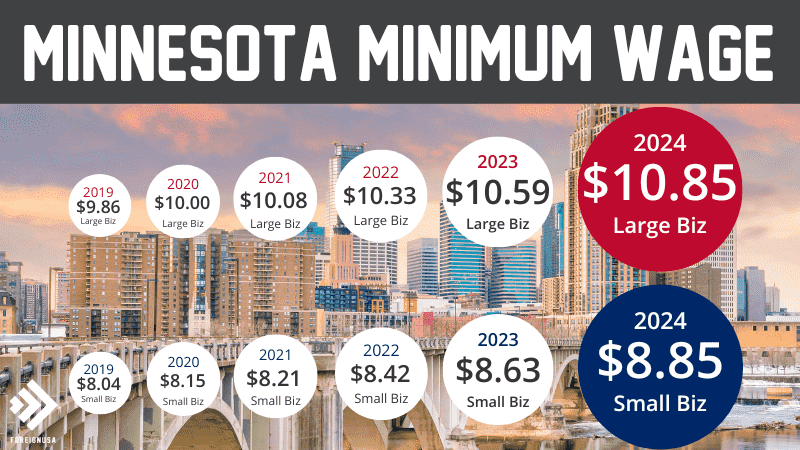

Feel free to download the graphic below, consisting of the minimum wage rates in Minnesota over the past several years for both large and small employers:

2024 witnessed an increase in the minimum wage in Minnesota for both large and small businesses.

On January 1, 2024, the statewide minimum wage for large employers increased from $10.59 to $10.85 per hour.

Also, the minimum wage for small businesses increased from $8.63 to $8.85 in 2024.

In 2024, training and youth minimum wages are also set at $8.85 per hour.

Now, there are some variations to the minimum wage in Minnesota due to a variety of different reasons.

Variations of the Minnesota Minimum Wage

Minnesota, much like other states, has specific minimum wage laws for different fields of employment.

However, unlike most other states, the rules for tipped employees are slightly different, as employers cannot take tip credit against the minimum wage.

An employee has to be paid the minimum wage at the very least per hour, plus tips that they may earn in addition to this.

This table shows the different variations of the Minnesota minimum wage in 2024.

| Minimum Wage Description | Year | $ Wage Amount |

|---|---|---|

| Large Employer Wage | 2024 | $10.85 |

| Small Employer Wage | 2024 | $8.85 |

The table below shows the different variations of the Minnesota minimum wage rate in 2023.

| Minimum Wage Description | Year | $ Wage Amount |

|---|---|---|

| Large Employer Wage | 2023 | $10.59 |

| Small Employer Wage | 2023 | $8.63 |

| 90 Day Training Wage (Under 20 Years) | 2023 | $8.63 |

| Youth Wage (Under 18 Years) | 2023 | $8.63 |

The table below shows the different variations of the Minnesota minimum wage rate in 2022.

| Minimum Wage Description | Year | $ Wage Amount |

|---|---|---|

| Large Employer Wage | 2022 | $10.33 |

| Small Employer Wage | 2022 | $8.42 |

| 90 Day Training Wage (Under 20 Years) | 2022 | $8.42 |

| Youth Wage (Under 18 Years) | 2022 | $8.42 |

The next table shows you the different variations of the Minnesota minimum wage rate in 2021.

| Minimum Wage Description | Year | $ Wage Amount |

|---|---|---|

| Large Employer Wage | 2021 | $10.08 |

| Small Employer Wage | 2021 | $8.21 |

| 90 Day Training Wage (Under 20 Years) | 2021 | $8.21 |

| Youth Wage (Under 18 Years) | 2021 | $8.21 |

In Minnesota, should you surpass 48 hours of work in a week, you are eligible for overtime pay.

However, if, as an employer, you are subject to the Fair Labor Standards Act, you must begin to pay the overtime rate as soon as your employee surpasses 40 hours in a working week.

The overtime pay is 1.5 times the regular minimum wage rate. So, $16.27 per hour is the overtime minimum wage rate for large business employees in Minnesota.

The overtime minimum wage for the rest of Minnesota employees is $13.27 per hour.

Latest News on the Minnesota Minimum Wage

Employers and employees are often affected by the minimum wage rates set by each state.

Employers argue that setting the minimum wage too high results in costs that are not feasible to run a profitable business, while employees argue that they cannot keep up with the cost of living if the minimum wage is too low.

We have rounded up the latest news surrounding the minimum wage in Minnesota and how it is affecting employers and employees alike.

Lyft and Uber Consider Leaving Minneapolis: These two ride-sharing companies are threatening to leave Minneapolis if the Council passes an ordinance that includes a number of rideshare worker protections, including a minimum wage for Uber and Lyft drivers. Minneapolis is debating the minimum wage as gig workers across the country are advocating for fair wages and job benefits. Read the full story.

Minnesota Minimum Wage History

The table below shows the current rate and the complete history of Minnesota’s minimum wage over the past 40+ years since 1983.

You can see when there were increases in the minimum wage each year, how much they were, and what percentage increase it represents each year.

Here are some notable minimum wage increases in Minnesota over the past 40+ years.

Minnesota Labor Law Poster and Department of Labor and Industry Contact Details

As a Minnesota employer, you need to keep yourself compliant with the law. To do this, you need to display a Minnesota Labor Law poster in a prominent place.

The good news is that you can acquire one of these posters for free from the Department of Labor and Industry website, and download the poster in English and 15 other languages.

If you wish to contact the department directly, here are all of the contact details you need:

Department of Labor and Industry

443 Lafayette Rd, St Paul,

MN 55155, USA

Telephone: +1 651-284-5005

Email: helpdesk.dli@state.mn.us